РАСЧЕТНОЕ ЗАДАНИЕCustoms transit procedures are designed to facilitate, as much as possible, the movement of ‘safeguarded’ goods in international trade and to provide countries in which the transfer of goods occurs with the necessary safety checks and customs guarantees. The spirit of the system is to reconcile the controlling needs of customs authorities with the needs of traders to move goods without having to comply with excessively burdensome formalities. Furthermore, customs transit is one of the cornerstones of European integration and an issue of vital interest to European businesses. It actually epitomizes the first implementation of the principle of (controlled) freedom in the movement of the goods. The (external and internal) transit procedures are applicable to the goods moving from one State to another. The transit system enables goods to move freely to the point of destination in packets or other transport units sealed by competent customs authorities. Because of its dynamic features, the transit system is one of the most used duty-suspension arrangements in the EU. However, it has often led to large- scale frauds. In view of achieving higher safeguards, Regulation (EC) No. 2787/00 of 15 December 2000 and ultimately Regulation (EC) No. 444/02 of 11 March 2002 amended Regulation (EEC) No. 2454/93 of 2 July 1993 (Customs Code Implementing Procedures (CCIP)). They both aimed to remedy flaws in the previous system and thus to prevent fraud, so as to fulfil the needs for tax safety and secure trade. Traditionally, the transit system features three different procedures: 1. Community transit. 2. Common transit. 3. TIR procedures

In addition, Regulation (EEC) No. 2787/20(X) introduced the New Computerized Transit System (New Computerized Transit System (NC fS)), which is surely destined to play a vital role over the years.

COMMUNITY TRANSIT

Community transit enables goods to move freely within the territory of the EU without being subject to any customs duties or restrictive commercial policy measures. It has two categories: 1. external transit (Community Customs Code (CCC), Articles 91 and following; Modernized Customs Code (MCC), Articles 10 and 144) for non-Community goods; and 2. internal transit (CCC, Articles 163 and following; MCC, Article 145) for Community goods.

The External Transit Procedure According to CCC, Article 91, the external transit procedure allows the movement from one point to another within the customs territory of the Community of non-Community goods that are not in free circulation, namely under arrangements where the payment of duties and other domestic taxes is suspended. It also allows such movement in respect to Community goods that are to be exported or re-exported to third countries. The goods are placed under the external transit procedure under cover of the Single Administrative Document (SAD) bearing the ‘Tl’ symbol.

The Internal Transit Procedure According to CCC, Article 163, the internal transit procedure allows Community goods to pass through the territory of a third country, such as Switzerland, on their way from one point to another within the Community customs territory and still remain Community goods. The goods are placed under the internal transit procedure under cover of the SAD bearing the ‘T2’ symbol.

Description of the Procedure The following is a description of the Community transit procedure: The transit declaration (Tl or T2) is presented at the office of departure by the principal, who is the holder of the transit procedure and is also responsible for the provision of a guarantee to cover the amount of suspended customs duties. For the transit declaration, Copies No. 4 and No. 5 of the SAD are used. The office of departure registers the transit declaration by putting a registration number and sets a time limit within which the goods shall be presented at the office of destination; the office identifies the consignment and affixes the seals on it so as to prevent any breakage during the transport and returns Copies No. 4 and No. 5 of the SAD to the trader. The principal presents Copies No. 4 and No. 5 of the SAD and the goods to the office of destination (CCC, Article 96). The office of destination registers the transit declaration and, after the required checks, reports that the operation is regular on the back of Copy No. 5 of the SAD and returns it to the office of departure. The office of departure verifies the consignment (end of the procedure) at the receipt of Copy No. 5 of the SAD and releases the guarantee provided by the principal, who is thus released from his obligations. According to CCIP Article 365, if Copy No. 5 of the transit declaration is not returned to the office of departure within two months of the date of acceptance of the declaration, that office shall inform the principal and ask the principal to furnish proof that the procedure has ended by way of a document identifying the goods and establishing that they have been presented at the office of destination. Where the office of departure has not received proof within four months of the date of acceptance of the transit declaration that the procedure has ended, it shall initiate the enquiry procedure. Where an enquiry does not establish that the transit procedure ended correctly, the office of departure shall notify the principal that it has initiated a recovery procedure of the customs debt by using the guarantee provided when the goods were placed under the transit procedure.

The Guarantee The principal must provide competent customs authorities with a guarantee, as a precaution to safeguard customs debts incurred where the procedure is not discharged. The guarantee can be individual, comprehensive, reduced or waived. Individual Guarantee The individual guarantee covers one transit operation and covers the full amount of customs debt liable to be incurred on the basis of the highest rates applicable to goods in the Member State of departure Regulation (EC) No. 444/02 of 1I March 2002 partially amended Article 345 of CCIP, in that the guarantee also covers import duties calculated on the basis of the Community Tariff. Before enactment of this provision, the guarantee, which was calculated on the basis of domestic taxation only, was often insufficient to cover import duties for Community goods under the transit procedure.

The individual guarantee may be: 1. in the form of a cash deposit: in this case, it shall be lodged at the office of departure and shall be repaid when the procedure has been discharged; and 2. furnished by a guarantor: in this case, it may consist of individual guarantee vouchers for the amount of EUR 7,000, issued by the guarantor to persons who intend to act as principal (CCIP Article 345).

Comprehensive Guarantee The comprehensive guarantee covers all of the operations carried out by the principal and can be used up to a ‘reference amount’. The reference amount shall be the same as the amount of customs debt that may be incurred in respect to the goods that the principal places under the Community transit procedure during a period of at least one week. The office of guarantee shall establish the amount in collaboration with the party concerned on the basis of the information on goods carried in the past and an estimate of the volume of intended transit operations. Furthermore, account shall be taken of the highest rates applied to the goods by the Member State of the office of guarantee (CCIP Article 379). Also in this case, reference should be made to Regulation (EC) No. 444/ 2002 adding a new paragraph to Article 379, which introduced to the comprehensive guarantee the same calculation criteria used for establishing the amount of individual guarantees, namely, taking into account of import duties. The comprehensive guarantee is subject to the granting of an authorization. According to Article 373, the authorization shall be granted only to persons who: - are established in the Member State where the guarantee is furnished; - regularly use the Community transit arrangements; and - have not committed any serious or repeated offences against customs or tax legislation.

Guarantee Reduction According to Article 380, CCIP, the amount to be covered by the comprehensive guarantee may be reduced: - to 50% of the reference umount where the principal demonstrates that (1) his finances are sound and that (2) he has suf ficient experience in the Community transit procedure; and - to 30% of the reference amount where, in addition to the two requirements mentioned above, the principal demonstrates that he cooperates very closely with the customs authorities.

Guarantee Waiver A guarantee waiver may be granted where the principal demonstrates that he or she satisfies the requirements for guarantee reduction, is in command of transport operations and has sufficient financial resources to meet his or her obligations.

Non-discharge of Community Transit Procedures In order to rationalize recovery in case of non-discharge of the transit procedure, Regulation (EC) No. 444/2002 amended the procedure of notification to the guarantor. The customs authorities of the Member State of departure (in lieu of the customs authorities competent for recovery, as provided for until 31 March 2002) shall notify the guarantor that the procedure has not been discharged within twelve months of the date of acceptance of the transit declaration. The customs authorities competent for recovery notify the guarantor of the payment due within three years of the date of acceptance of the transit declaration. The guarantor shall be released from his obligations if either of the notifications has not been issued to him before the expiry of the respective time limits.

Simplified Procedures Traders who are granted the status of ‘authorized consignors’ (CCIP Articles 38 and following) can carry out Community transit operations without presenting the goods and the corresponding transit declaration at the office of departure. This authorization shall be granted solely to persons authorized to use a comprehensive guarantee or granted a guarantee waiver. The same shall apply in the case of traders who are granted the status of authorized consignee', under which they can receive goods at their premises or at any other specified place for the Community transit procedure without presenting the goods and Copies No. 4 and No. 5 of the transit declaration at the office of destination.

THE TIR SYSTEM

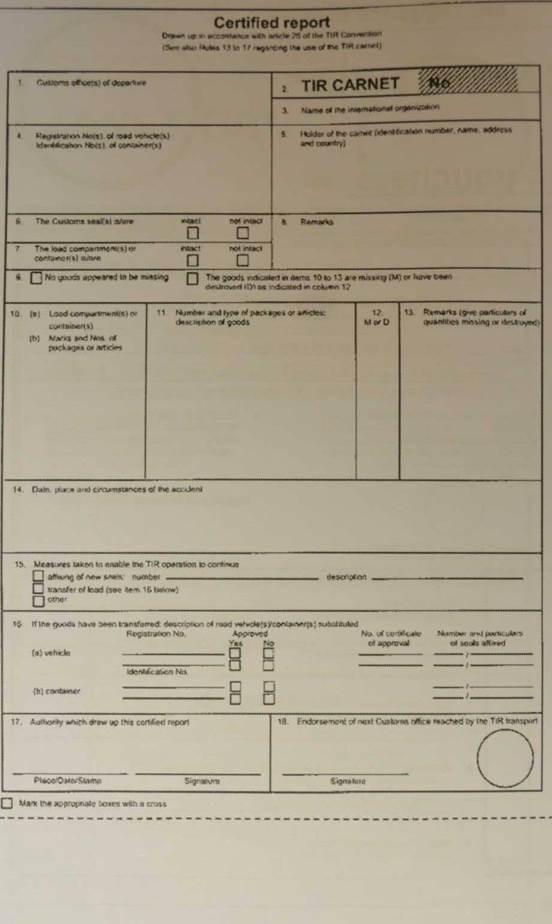

The TIR (Transports Intemationawc /towners/International Road Transports) procedure is established in the TIR Convention, adopted in Geneva on 14 November 1975 and ratified in Italy by Law No. 706 of 12 August 1982. Currently, sixty-four countries, including all Member States of the EU, are signatories of the Convention. The TIR procedure allows goods carried by road vehicles, combination of vehicles and containers, which were checked and sealed by the customs authorities of the country of departure, to cross the borders and the territory of Contracting States without being subject to examination at the customs office en route. Only the customs authorities of the State of destination shall examine the goods. The TIR system is based on five fundamental principles: Goods should travel in secure vehicles or containers. Throughout the journey, duties and taxes at risk should be covered by an internationally valid guarantee. The goods should be accompanied by an internationally accepted TIR Carnet obtained in the country of departure and serving as a control document in the countries of departure, transit and destination. Customs control measures taken in the country of departure should be accepted by the countries of transit and destination. Only competent national authorities can authorize the use of a TIR procedure to national associations issuing the TIR Carnet and natural and legal persons using the TIR Carnet.

The TIR C ARNET In the TIR system, the ‘TIR Carnet’ serves the fundamental purpose of customs declaration and guarantee. TIR Carnets are issued by the International Road Transport Union (IRU) to the national guaranteeing association, under the supervision of the Executive Board. Each guaranteeing association in turn issues the TIR Carnets to carriers in its country in accordance with the conditions set out in the declaration of commitment signed by the carrier with the association. The TIR Carnet remains valid until completion of the TIR operation at the customs office of destination, provided it has been brought into operation at the customs office of departure within the time allowed by the issuing association. The TIR Carnets may contain fourteen or twenty vouchers, depending on the number of expected operations; generally, it is valid for forty-five days.

FUNCTIONING OF THE TIR PROCEDURE INGOING At the customs office of departure, which usually is the one where export formalities are performed, customs authorities check the load on the basis of information supplied in the TIR Carnet completed by the carrier. Afterward, customs authorities seal the vehicle, report it in the TIR Carnet, keep one sheet (the white voucher) and authenticate the corresponding counterfoil. The TIR Carnet is handed back to the carrier, who starts the transport operation. When the carrier crosses the outgoing border of that country, customs officials check the seals, detach a second sheet (the green voucher) from the TIR Carnet and authenticate the corresponding counterfoil. The vehicle may then leave the country; the authentication of both vouchers and counterfoils by customs authorities shows that the TIR operation in that country has been completed.

OUTGOING The outgoing customs office (i.e., at the border) sends the detached sheet (the green voucher) to the office of departure. The latter compares the received sheet with the one it initially retained.

TRANSIT The incoming customs office in a country of transit checks seals and withdraws one sheet from the TIR Carnet, and the outgoing office of the country of transit proceeds likewise. Both sheets are compared for a final control, and the operation is terminated

THE TIR SYSTEM CONTROL

If customs personnel suspect fraud, find the seals are faulty or fears the TIR Carnet has been tampered with, they check the goods. 113-2-5 Prescribed Transport Route To provide more efficient controls, customs authorities may prescribe a transport route along which vehicles are easily spotted with the TIR plate the> must bear. Furthermore, the journey should also be performed within a reasonable time limit. The carrier who cannot abide by prescribed travel times or routes for any reason should be able to justify himself. Transport Operations Carried Out under Cover of a TIR Carnet A European Court of Justice case gave a further interpretation to the notification period deadline. Article 2(1) of Commission Regulation (EEC) No. 1593/91 of 12 June 1991 providing for the implementation of Council Regulation (EEC) No. 719/91 on the use in the Community of TIR carnets and AT A Admission Temporaire/Temporary Admission) carnets as transit documents, read in conjunction with.Article 11(1) of the Customs Convention on the International Transport of Goods under Cover of TIR Carnets, signed in Geneva on 14 November 1975. must be interpreted as meaning that failure to comply with the period within which the holder of a TIR carnet is to be notified of its non-discharge does not have the consequence that the competent customs authorities forfeit the right to recover the duties and taxes due in respect to the international transport of goods made under cover of that carnet. Article 2(2) and (3) of Regulation (EEC) No. 1593/91. read in conjunction with Article 11(1) and (2) of the Customs Convention on the International Transport of Goods under Cover of TIR Carnets, signed in Geneva on 14 November 1975, must be interpreted as determining only the period within which proof is to be furnished of the regularity of the transport operation and not the period within which proof must be provided as to the place where the offence or irreeularitv was committed. It is for the national court to determine, according to the principles of national law. Whether, in the specific case before it and in the light of all the circumstances, that proof was furnished within the period prescribed. However, the national court must determine that period in compliance with Community law and, in particular, must take account of the fact, first, that the period must not be so long as to make it legally and materially impossible to recover the amounts due in another Member State, and, second, that that period must not make it materially impossible for the TIR Carnet holder to furnish that proof.

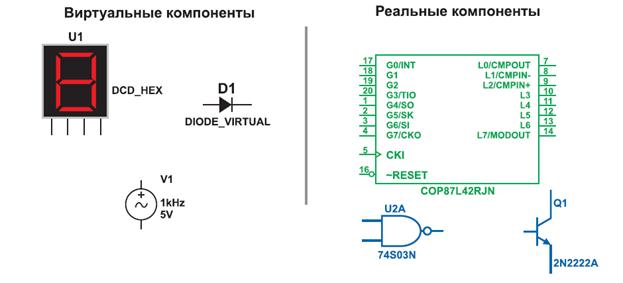

NEW COMPUTERIZED TRANSIT SYSTEM Regulation (EC) No. 2787/2000 also introduced a new system for managing and monitoring the transit system, the NCTS. The NCTS can be used for internal and external Community transit procedures and Common Transit. The NCTS is a tool to remedy an actual flaw in the transit procedures, that is, the notification of the discharge by the office of departure, which shall be replaced by an electronic communication. Furthermore, the NCTS shall be an important tool for customs authorities to combat smuggling. Currently, the system is supported by the customs authorities of all Contracting States to the ‘Convention on a common transit procedure’ as of 30 June 2003. Functioning of the NCTS Consignors and traders may use the NCTS procedure, when they satisfy certain requirements and possess specified structures. It is only necessary to be able to use Electronic Data Interchange (EDI) procedures to communicate with customs authorities in order to connect to the NCTS. The transit declaration is presented to the office of departure, either in paper form (in this case, data are entered in the system of the customs office) or in a computerized form. Annex 1 to Regulation (EC) No. 444/2002 of 11 March 2002 added a paragraph to Annex 37 to the CCIP: Where a transit declaration is processed at an office of departure by a computerized system, one copy of the declaration must be lodged at that office. The declaration must contain all of the data required and comply with the specifications of the system, which codifies and validates the data. Once the declaration is accepted, the system will provide the declaration with a unique registration number, the 'movement reference number*. Then, once the guarantees are accepted, either at the office of departure or at the authorized consignor's premises, the goods will be released for transit. The office of departure will also send an anticipated arrival record to the declared office of destination and an anticipated transit record to the office of transit so that the office of destination can check the consignment while the office of transit can check the passage of the goods. Upon arrival, the goods must be presented at the office of destination with the accompanying transit document The customs authorities, having alreadv received the anticipated arrival record, will have full details about the operation: thev can decide beforehand what controls are necessary and send an arrival advice message to the office of departure. After the relevant controls have been carried out the office of destination I will notify the office of departure of the control results by using a control results I message, stating w hich. if any, irregularities have been detected. The control results message is necessary to discharge the transit operation at the office of departure and release the guarantees that were used for it. Figure 11.2. Scheme of the New Computerized Transit System

PROCEDURE AT DESTINATION

SIMPLIFIED PROCEDURE

As to the use of computerized transit, Regulation (EC) No. 444/2002 amended CCIP Article 359, which now provides that the office of departure - as reference office for computerized communications - can be directly notified of the passage of the goods through an office other than the one originally indicated in the transit declaration.

SIMPLIFIED PROCEDURES Combining the NCTS with simplified procedures enables the carrying out of all the procedures at the consignor’s own premises. The electronic exchange of information with customs authorities is clearly the most rapid, comfortable, secure and economic way of doing business. All these advantages lead to considering the NCTS the transit procedure of the future. ADVANTAGES OF THE NCTS The NCTS improves the quality of service and reduces the amount of time waiting at customs, resulting in the earlier discharge of the transit procedure & results in a reduction in the costs and effort associated with the complicated paper-based procedures, because the management of all movement of goods is computerized. In particular, the NCTS provides the following benefits: - greater flexibility in presenting the declarations; - reduction in the costs with respect to the paper-based procedure; - authorized consignor/consignee are connected to the NCTS, so that they no longer need to comply with the burdensome formalities of the traditional system: information is directly exchanged through the system* - effectiveness: only valid declarations are accepted, the validity of guarantees is checked and relevant use is monitored; - reductions in waiting time at the office of transit and of destination, as anticipated transit data are sent electronically. Customs can decide whether or not to check the consignment before the arrival of the goods; - greater transparency: the trader can track down the transit by accessing customs files; - at the destination point, the trader can benefit from accessing the NCTS data that were recorded at the point of departure, in order to place the goods under another customs arrangement; and - earlier discharge of the transit procedure, as an electronic message is sent instead of the Copy No. 5 of the SAD T1, leading to a faster release from the guarantee.

NEW RULES FOR COMMUNITY TRANSIT AND TIR REGIME Reg (EC) No. 1192/2008 has introduced new dispositions for the community transit and TIR regime, having pursued – on these specific topics – the following objectives: - to adapt the discipline of the community transit to the new EU security provisions, taking into consideration the NCTS; - to adapt the TIR regulations to the implementation of the computerized system (NCTS-TIR), integrating it with the security rules.

ANDORRA In 1990, the EC and Andorra concluded a customs union by an Agreement in the form of an Exchange of Letters[1]. The customs union applies to trade in goods falling within Chapters 25-97 of the Harmonized System (HS). By Decision No. 1/96 of the EC-Andorra Joint Committee,[2] the Community transit procedure as laid down in the CCC and its implementing provisions (Integrated Program for Commodities (IPC)), was extended to trade falling within the scope of the customs union. The decision was subsequently replaced by Decision No. 1/2003 of the EC-Andorra Joint Committee[3]. Goods Falling within Chapters 1-24 HS The export and import of goods falling within these chapters with as destination or origin Andorra are treated as third country exports or imports. A SAD is therefore presented, with in Box 1 the abbreviation EX for export and IM for import. Goods Falling within Chapters 25-97 HS Decision No. 1/2003 provides the basis for applying mutatis mutandis the Community transit procedure laid down in the CCC and IPC to trade between the Community and Andorra in goods falling within Chapters 25-97 HS. Customs formalities need to be completed in trade between the Member States of the Community and Andorra in a manner analogous to the situation that existed before the establishment, in 1993, of the internal market. Thus, a SAD is presented, with in Box 1 the abbreviation EX for export and IM for import. In this context the following cases must be distinguished: goods in free circulation, as defined by the Customs Union Agreement, move under the internal Community transit procedure (T2) (T2F), or (T2L); goods not in free circulation move under the external Community transit procedure (Tl); and specific case of products referred to in Regulation (EEC) No. 3448/93[4] move under the external Community transit procedure (Tl) The guarantee provided for under the Community transit proce ure must he valid for both the Community and Andorra. In the guarantee documents and certificates the words ‘Principality of Andorra’ must not be deleted. SAN MARINO In 1992, the EC and San Marino concluded an Interim Agreement on trade and Customs Union[5]. The agreement was replaced by the Agreement on cooperation and Customs Union[6] that entered into force on 1 April 2002. The customs union applies to goods falling within Chapters 1-97 of the Common Customs Tariff (CCT), with the exception of the products falling within the scope of the Treaty establishing the European Coal and Steel Community (‘ECSC products’) of Chapters 72 and 73. Decision No. 4/92 of the EEC-San Marino Co-operation Committee[7] determined the provisions concerning the movement of goods between the Community and San Marino. The decision applied as from 1 April 1993 and was amended by Decision No. 1/2002[8], which took effect on 23 March 2002. Decision No. 4/92, as amended, coordinates the methods of administrative cooperation between San Marino and the EC in applying the rules of the Community transit procedure. The following rules apply to the movement of goods falling within the scope of the EC-San Marino customs union (Chapters 1-97 CCT with the exception of ‘ECSC products’).

GOODS MOVING FROM DESIGNATED COMMUNITY OFFICES IN ITALY TO SAN MARINO Goods moving under a Tl procedure with destination San Marino shall be released for free circulation at one of the designated Community customs offices in Italy[9]. The common transit procedure is not applicable to trade with San Marino. San Marino is not a Contracting Party to the TIR convention. NON-FISCAL TERRITORIES The following territories (known as the non-fiscal territories), although part of the customs territory of the Community, are not included in the fiscal territory of the Community: The Channel Islands. The Canary Islands. The following French Overseas Departments: Guadeloupe, Martinique, Guiana and Reunion. Mount Athos. — The Aland Islands. The provisions of Directive 77/388/EEC do not apply in the non-fiscal territories. In order to ensure that fiscal charges (value added tax (VAT) and Excise duties) are controlled and accounted for, the intra-Community movement of Community goods moving to from or between the non-fiscal territories shall be covered by the internal Community transit procedure, where applicable, or customs status documents. INTERNAL COMMUNITY TRANSIT PROCEDURE The internal Community transit procedure for movements covered by IPC Article 340(c) is known as the 129 T2F procedure and will apply as follows: - Transit declaration on the SAD: - Enter the symbol T2F in Box 1 of the SAD. Airline or shipping company (authorized regular shipping) manifest used as the transit declaration (Level 1 simplification): Enter the symbol T2F on the relevant manifest. Airline or shipping company (authorized regular shipping) manifest used as the transit declaration (Level 2 simplification): Enter the symbol TF in respect of the Community goods in question.

CUSTOMS STATUS DOCUMENTS Where the use of the T2F transit procedure is not mandatory (e.g., on a nonregular shipping service) and status documents are used to prove the Community status of goods moving to, from or between the non-fiscal territories, the following will apply: SAD or commercial documents used as status document: Enter the symbol T2LF in Box 1 of the SAD or on the commercial documents. Shipping company’s (non-regular service) manifest used as status document: Enter the symbol F in respect of the Community goods in question. The ‘F’ shall be considered a ‘special endorsement’ within the meaning of Article 9(4) of the Convention. REFERENCES Treaties and Legislation Customs convention on the international transport of goods under cover of TIR carnets (Convention TIR, 1975). EC/EFT A Convention of 20 May 1987 on a common transit procedure amended by: Decision No. 1/99 of the EC/EFTA Joint Committee of 12 February 1999 (NCTS); Decision No. 2/99 of the EC/EFTA Joint Committee of 30 March 1999 (NCTS and CCN/CSI); Decision No. 1/2000 of the EC/EFTA Joint Committee of 20 December 2000 (general reform). Articles 91 through 97 (external transit procedure), Articles 163 through 165 (internal transit procedure) of Council Regulation (EEC) No. 2913/92 (CCC). Articles 62, 63, 136, 140, 143, 144, 146, 147 and 103, 143 and 145 of Regulation (EC) No. 450/08 (MCC). Articles 340(a) through 408(a) of Commission

Literature. Regulation (EEC) No. 2454/93 (CCIP). Commission Regulation (EEC) No. 1469/88 of 26 May 1988 amending Regulation (EEC) No. 1062/87 on provisions for the implementation of the Community transit procedure and for certain simplifications of that procedure, and Regulation (EEC) No. 2793/86 and (EEC) No. 2855/85. Council Regulation (EEC) No. 3648/91 of 11 December 1991 laying down the methods of using Form 302 and repealing Regulation (EEC) No. 3690/86 concerning the abolition, within the framework of the FIR Convention, of customs formalities on exit from a Member State at a frontier between two Member States and Regulation (EEC) No. 4283/ 88 on the abolition of certain exit formalities at internal Community frontiers - introduction of common border posts. Council Regulation (EEC) No. 881/92 of 26 March 1992 on access to the market in the carriage of goods by road within the Community to or from the territory of a Member State or passing across the territory of one or more Member States. Council Regulation (EEC) No. 2913/92 of 12 October 1992 establishing the Community Customs Code. Council Regulation (EEC) No. 3637/92 of 27 November 1992 on a system of distribution of Rights of Transit (Ecopoints) for heavy-goods vehicles with a laden weight of over 7.5 tonnes registered in a Member State transiting through Austria. Council Decision No. 92/577/CEE of 27 November 1992 concerning the conclusion of the Agreement between the European Economic Community and the Republic of Austria on the transit of goods by road and rail. Council Decision No. 92/578/CEE of 30 November 1992 concerning the conclusion of the Agreement between the European Economic Community and the Swiss Confederation on the carriage of goods by road and rail. Commission Regulation (EEC) No. 2454/93 of 2 July 1993, laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 3665/93 of 21 December 1993 amending Commission Regulation (EEC) No. 2454/93 of 2 July 1993, laying down provisions for the implementation of Council Regulation (EC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 2193/94 of 8 September 1994 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 3254/94 of 19 December 1994 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 3298/94 of 21 December 1994 laying down detailed measures concerning the system of rights of transit (ecopoints) for heavy-goods vehicles transiting through Austria, as established in the Act of Accession of Austria, Finland and Sweden, Article II of Protocol 9. Council Regulation (EC) No. 1356/96 of 8 July 1996 on common rules applicable to the transport of goods or passengers by inland waterway between Member States with a view to establishing freedom to provide such transport services. Commission Regulation (EC) No. 1676/96 of 30 July 1996 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 12/97 of 18 December 1996 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Decision No. 2/97 of the EC/EFTA Joint Committee on Common Transit of 23 July 1997 amending Appendices I and II of the Convention of 20 May 1987 on a common transit procedure. Commission Regulation (EC) No. 1427/97 of 23 July 1997 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 75/98 of 12 January 1998 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 502/1999 of 12 February 1999 amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Regulation (EC) No. 955/1999 of the European Parliament and of the Council of 13 April 1999 amending Council Regulation (EEC) No. 2913/92 with regard to the external transit procedure. Resolution of the EC-EFTA Joint Committee on common transit of 2 December 1999 on the reform of the common transit system. Commission Regulation (EC) No. 1602/2000 of 24 July 2000, amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 2787/2000 of 15 December 2000, amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 993/2001 of 4 May 2001, amending Regulation (EEC) No. 2454/93 laying down provisions lor the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Commission Regulation (EC) No. 444/2002 of 11 March 2002, amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code and Regulations (EC) No. 2787/ 2000 and (EC) No. 993/2001. Commission Regulation (EC) No. 1192/2008 of 17 November 2008, amending Regulation (EEC) No. 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No. 2913/92 establishing the Community Customs Code. Case Law Judgment of 11 July 2002 - Court of Justice of the European Communities - Chamber V. Title 1: Article 7(3), Sixth Directive 77/388/CE - Importation - External Community transit procedure - Irregularities under the external Community transit procedure - Irregularities in the territory of different Member States - Removal of goods from customs arrangements in the territory of the State where irregularities were committed - Concept of removal from customs supervision. Title 2: Sixth Directive 77/388/CEE - Sixth Directive 77/388/CE - Importation - External Community transit procedure - Removal from customs supervision - Relevant - Even if there is no intent

CUSTOMS WAREHOUSING

Customs warehousing falls into the broad category of customs procedures with economic impact, which includes inward processing, processing under customs control, temporary admission and outward processing. Customs procedures with economic impact are customs law institutions governing the operations under which foreign goods are entered into the EU customs territory according to the use intended by the persons declaring the goods. They are called ‘with economic impact’, as their specific use is linked mainly to an overall reduction in the final costs of the product. When using customs procedures with economic impact, the goods do not lose their foreign or Community status, unlike goods released for free circulation (import) or Community exported goods (export). In particular, customs warehousing is a suspensive customs procedure with economic impact, which enables storage of non-Community goods within the EU without their being subject to the payment of import duties and national taxes, even in derogation of commercial policy measures. Goods are to be stored in authorized warehouses under customs supervision.

Unless otherwise provided for by local customs authorities, no time limit is set for the storage of goods in a customs warehouse (except in the case of goods eligible for the payment of export refunds, such as agricultural products). According to CCC, Article 98 ‘Customs warehouse means any place approved by and under the supervision of the customs authorities where goods may be stored under the conditions laid down’.

CUSTOMS WAREHOUSING 12.2 Purposes of the Procedure 12.2 PURPOSES OF THE PROCEDURE CCC, Article 98 (MCC, Articles 143, 148 and 153) establishes that the customs warehousing procedure allows the storage in a customs warehouse of: non-Community goods, without such goods being subject to import duties or commercial policy measures; Community goods, where Community legislation governing specific fields provides that their being placed in a customs warehouse attracts the application of measures normally attaching to the export of such goods. 123 TYPES OF WAREHOUSES CCC, Article 99 (MCC, Article 153) provides that a customs warehouse may be either: - public, where ‘available for use by any person for the warehousing of goods’; or private, where ‘reserved for the warehousing of goods by the warehouse-keeper’. CCIP, Article 525 establishes that public and private warehouses can be classified in three different ways. Thus, each warehouse has its own features. Public warehouses can be distinguished in accordance with the following categories: - type A, if the responsibility lies with the warehouse-keeper; type B, if the responsibility lies with the depositor; type F, if the warehouse is operated by the customs authorities. Private warehouses can be categorized as follows: type C, where neither of the special situations under type A and B can be applied. In this case, the warehouse-keeper is generally the same person as the depositor but is not necessarily the owner of the goods; type D, where release for free circulation is made by way of the local clearance procedure and may be granted on the basis of the nature, the customs value and the quantity of the goods to be taken into account at the time of their placement under the warehousing arrangements. In other words, the holder of a warehouse is also the holder of a local clearance procedure; customs duties to be paid for the release for free circulation are assessed at the time of the placement of the goods under the customs warehousing arrangements; ~ tyPC B’ arrangements apply although the gcxxis need not be stored in a place approved as a customs warehouse. To a large extent, the goods can be stored in manufacturing/distribution units, regardless of their being approved as a customs warehouse. To sum up, a public warehouse is a place managed as a business, where the warehouse-keeper supplies the depositor with a service of warehousing goods ‘in foreign status’. Conversely, a private warehouse is a place where the warehouse-keeper stores his own goods or goods owned by other private individuals ‘in foreign status’. There is no time limit to the length of time during which goods may remain under the customs warehousing procedure. In exceptional cases, however, the customs authorities may set a time limit by which the depositor must assign the goods to a new customs-approved treatment or use. WAREHOUSE-KEEPER The warehouse-keeper is the person authorized to operate the customs warehouse and, in some cases, may be different from the depositor, who is the person bound by the declaration placing the goods under the customs warehousing procedure. Generally speaking, the warehouse-keeper is responsible, as laid down in CCC, Article 101 (MCC, Article 149): for ensuring that while the goods are in the customs warehouse, they are not removed from customs supervision; for fulfilling the obligations that arise from the storage of goods covered by the warehousing procedure; for satisfying the particular conditions set out in the authorization. CCC, Article 104 (MCC, Article 136) provides that the customs authority may demand that the warehouse keeper provide a guarantee to operate the customs warehouse.

AUTHORIZATION Any person wishing to operate a customs warehouse must apply for an authorization under Articles 85 and 100 of Regulation (EEC) No. 2913/92 of 12October 1992 (CCC) (MCC, Article 36; in conjunction with Article 497, CCIP. In particular, lor customs warehousing, the request mu si he made lo I he customs author H ies designated lor the place to he approved as a customs warehouse 01 where the applicant’s main accounts are held. Authorization Pkocigduric The applicant shall he informed of the decision to issue an authorization, or the reasons why the application was rejected, within sixty days of the date the application was lodged or the date the customs authorities receive any requested additional information. It is worthwhile pointing out that although generally an authorization takes el ici t on the date of issue, for customs warehousing, the customs authorities may make the exception of communicating their agreement to use the arrangements prior to the actual issuing ol the authorization. As to the duration, Article 507 of Regulation (EEC) No. 2454/93 expressly provides that no limit on the period ol validity shall he fixed for authorizations. The applicant and the customs authorities shall use the form as laid down in Annex 67 to CCIP, as amended by Regulation (EC) No. 993/2001. Application for Authorization Regulation (EEC) No. 2454/93 specifies that applications for authorization shall be made in writing using Annex 67 to the Implementing Regulation itself. In this regard, it should be pointed out that the application requires a thorough analysis of the company’s needs and of relevant compliance with the (Community law requirements, so that customs authorities can be aware of all operational aspects for the purposes of the warehousing procedure. Furthermore, before granting the authorization, customs authorities shall examine whether there is actually an economic need to store the goods in ‘foreign status’ in a certain location. Finally, it should be pointed out that there is an objective limitation to the granting of the authorization under Article 527 of Regulation (EEC) No. 2454/93, which provides that authorizations shall not be granted where warehouses or the storage facilities are used for the purpose of retail sale, unless goods are sold free of import duties: to travellers in transit to third countries; to members of international organizations or to NATO forces; or under diplomatic or consular arrangements DECLARATION OF ENTRY TO CUSTOMS WAREHOUSING AND FOLLOWING REMOVAL Goods to be entered lor customs warehousing shall be presented to customs along with relevant declarations on a form complying with the Single Administrative Document (SAD). After the applicant presents the declaration to customs, he can store the goods in the customs warehouse without being subject to customs duties and commercial policy measures. In general, the declaration shall contain all data to identify the goods to be stored; it is not necessary to indicate their correct classification and value. The only exception is type D goods, in which case relevant value must be declared in advance. The procedure will be ‘discharged’, namely ended, when the goods are removed to other customs-approved use. Taxes due will be assessed at the moment of the removal of the goods from the customs warehouse for processing for home use. STOCK RECORDS According to Article 528 of Regulation (EEC) No. 2454/93, in warehouses of type A, C, D and E, the warehouse-keeper shall be the person designated to keep specific stock records to verify and check the goods placed under the customs warehousing procedure.

In warehouses of type F, the stock records shall be kept directly by the relevant customs office, while in type B warehouses, in place of stock records, the supervising customs office shall keep the declarations of entry for the arrangements. As stock records are intended to verify the quantity of the goods stored in foreign status, under Article 529 of Regulation (EEC) No. 2454/93, they shall also contain information concerning the temporary removal of goods. HANDLING OF THE GOODS The basic purpose of the customs warehousing procedure is to allow the storage of non-Community goods. However, the warehouse-keeper is authorized to undertake the forms of handling intended to preserve them, improve their appearance, or prepare them for distribution or resale. These authorized operations are defined in accordance with the usual forms of handling set forth in the list contained in Annex 172 to CCIP, as referred to in Article 531 The warehouse-keeper must ask for authorization trom the supervising customs office. TEMPORARY REMOVAL CCIP, Article 110 provides that where circumstances so warrant, goods placed under the customs warehousing procedure may be temporarily removed from the customs warehouse. Such removal must be authorized in advance by the customs authorities, which shall stipulate the conditions on which it may take place. Goods may be temporarily removed for a period not exceeding three months. In special cases, the time limit can be extended if there is a valid justification. SPECIAL WAREHOUSES: TYPE D AND TYPE E It is worthwhile examining in greater depth two types of private warehouses that are different from the general (traditional) customs warehousing procedure of type C. Furthermore, their features make them ideal for multinational enterprises wishing to use a customs warehouse with special logistics and administrative flexibility. Type D Warehouse Type D is a private customs warehouse where the warehouse-keeper is the same person as the depositor but is not necessarily the owner of the goods. What distinguishes the type D warehouse from other private warehouses is that relevant tax liability is quantified at a different moment in the warehousing process. Namely, duties follow the regime on input taxation, instead of output taxation. In other words, when goods are declared only after they are released for free circulation (as in the case of the type D warehouse), taxation is applied on the basis of the quantity, quality, origin and value of the goods at the time of origin, namely at the time of their entry into the warehouse, not of the time of their removal from the warehouse. This reflects on the way the goods are removed from the warehouse, which shall not be verified by the customs authorities nor be declared in advance. A type D warehouse is usually used when storage and distribution occur very quickly. 1 he type I) warehouse requires the keeping of very specific stock records. In fact, during their internal movements within the warehouse, it is necessary that the goods be identifiable at any moment in case of customs checks. In this regard, Article 105 of Regulation (EEC) No. 2913/92 provides that the person designated by the customs authorities - in this case, the warehousekeeper - shall keep stock records of all the goods placed under the customs warehousing procedure. In particular, the forms and guarantees of stock records are established at the granting of the authorization for the entry of the goods to the customs warehousing, according to the nature of the applicant’s activity; computerized systems may be used. In any case, where the records kept by the warehouse-keeper for tax purposes feature adequate guarantees of safety and reliability and contain the indications necessary to checks, customs authorities could admit their use also for customs purposes. With specific reference to type D warehouses, Article 525(2)(a) of Regulation (EEC) No. 2454/93 establishes that stock records shall contain information requested under Annex 37; in particular: identification data of the applicant; identification data of the consignee of the goods placed under customs warehousing procedure; indication, as prescribed by the Customs Code, of the customs- approved treatment to which the goods are assigned; customs declarations and documents by which the goods are assigned to a customs-approved treatment discharging the customs warehousing procedure; previous customs-approved treatments to which the goods were assigned; identification number and authorization number of the customs warehouse; information relevant to the movement of the goods; in particular, the location of their storage and transfers to different customs warehouses, if any; information relevant to temporary removal of the goods from the customs warehouse; information relevant to the usual forms of handling the goods; total number of declared items; commodity number; gross and net mass of the goods (with and without the packaging); information relevant to the nature, quantity and marks of the packaging; status of the containers crossing the European Community border, any other indication required by specific regulations;

indication of customs duties to be paid: taxable amount due and payment basis, rate of the duty Type E Warehouse Type E is a particular warehouse where the suspensive customs procedure with economic impact applies, although the goods need not be stored in a place approved as a customs warehouse (virtual warehouse). In general, a type E warehouse enables the storage of goods - everywhere on national and Community territory - without their being subject to customs duties and national taxes (VAT and excise duties). Goods can be cleared only when they are earmarked to customers or, in any case, at the moment of assigning a different customs-approved treatment to the goods. What is unique in the type E warehouse is that the customs warehousing procedure can cover different premises all over national and European territory by way of single accounts and interfacing with single customs authorities, which are chosen in advance. Stock records of type E warehouses shall keep track of the quantity of the goods placed under the customs warehousing procedure; in any case, the warehouse-keeper is asked to submit an inventory within ten days after each calendar four-month period. This type of customs warehouse shall operate through a single register of ‘stock records’, which is managed through a computerized system for all the places of storage - wherever they are located - for which the warehousekeeper shall be responsible. Significantly, a type E warehouse may cover many places of storage, between which the goods might be transferred without issuing any relevant customs document. In fact, according to Article 512 of Regulation (EEC) No. 2454/93 of 2 July 1993, as amended by Regulation (EEC) No. 993/2001 of 4 May 2001, ‘transfer between different places designated in the same authorization may be undertaken without any customs formalities’. When goods are entered into the type E warehouse arrangement, the entries are made in a computerized register - the ‘stock records’ - which can be kept at one of the locations to pilot and control all movements of goods within the type E arrangement.

In particular, the entry in the stock records shall take place when the goods arrive at the holder’s or consignor’s storage facilities, while the entry in the stock records relating to discharge of the arrangement shall take place at the latest when the goods leave the customs warehouse. Stock records shall also indicate if the goods undergo the usual forms of handling during their storage in the different locations of a type E warehouse, as well as if they are temporarily removed in accordance with Articles 532 and 533 of Regulation (EEC) No. 2454/93 of 2 July 1993. Special provisions are applied where both Community and non-Community goods are stored in the same location; specific methods of identification may be used to distinguish between Community and non-Community goods. Notwithstanding this special identification, where it is impossible to classify the goods, a common storage of Community and non-Community goods may be allowed if they have the same Combifed Nomenclature code, commercial qualities and technical features. It should be pointed out, however, that the forms and guarantees of (even computerized) stock records are established at the granting of the authorization for the entry of the goods into the customs warehousing, according to the nature of the applicant’s activity. In any case, where the records kept by the warehouse-keeper for tax purposes feature adequate guarantees of safety and reliability and contain the identification of goods necessary for inventory checks, customs authorities could admit their use also for customs purposes. According to Article 497 of Regulation (EEC) No. 2454/93, the application for authorization shall be made in writing using the model set out in Annex 67. The customs authorities may require additional details from the applicant, where they consider any of the information given inadequate. In particular, for customs warehousing, the application shall be made to the customs authorities designated for the place to be approved as a customs warehouse. For a type E warehouse, the leading authority is the office where the applicant’s main accounts are held.

As of from 2007, as previously pointed out, twenty-seven European countries are a single customs territory. In this context, the harmonization of customs taxation (differently than VAT and direct taxation) may be considered a cornerstone of Community integration, as it is possible to use (without barriers) all the instruments contained in the Community Customs Code (Regulation (EEC) No. 2913/92). This situation allows all resident enterprises carrying out their business in different Member States and with third countries (purchase of raw materials, finished and semi-finished products) to avail themselves of the pan-European arrangements provided by certain customs procedures with economic impact. Among them, the most interesting arrangement is certainly the ‘virtual warehouse’, which can be operated in the whole Union under the ‘SEA’ (Articles 500 and 501 of Regulation (EEC) No. 2454/93, as amended by Regulation [EC] No. 993/2001, see Chapter 10). This arrangement, in which the Code is referring to the type E warehouse, permits centralized stock records in the Community territory that are recognized by the customs authorities of all Member States concerned. The virtual warehouse enables the authorized economic operator to import and store goods without such goods being subject to customs duties and VAT (and excise duties when applicable, subject to special provisions) until they are removed (if within the EU territory). The storage can be managed in different premises, situated in different Member States, which are all placed under the single type E ‘warehouse’. It is not necessary that goods be stored in locations recognized as customs warehouses. In this case, as already pointed out, only one customs authority among twenty-five - the Leading Authority - is entitled to check. The economic operator shall keep single Community accounting records, which take into account the movement of goods entered into the virtual warehouse, and pay - monthly - the overall duty on all removals, wherever they may occur within the Community territory. Thus, when operating the warehouse, the authorized operator connects with one Customs office only, without any interfering from the other Community customs authorities that have previously authorized the warehouse. It is, however, important to point out that the Italian customs authorities are very cautious about this arrangement. Although they have already recognized the simplifications introduced in 2001 (see Circular No. 30/D of 28 June 2001), they actually find it hard to accept all the implications of pan-European schemes.

As already pointed out, as a matter of (Community) law, the arrangement allows storage of goods in premises situated on national and Community territory, by way of computerized accounting records, which are themselves (virtually) the warehouse.

12.10 Special Warehouses: Type D and Type E CUSTOMS WAREHOUSING Figure 12.1. Single European Authorization - Type E warehouse Customs warehouses

Many Northern European enterprises have long since adopted this strategic solution successfully, benefitting from advantages that Italian enterprises have not managed to obtain so far. One example above all is that of Honda Motor Europe, which operates a virtual warehouse in five Member States (Belgium, Great Britain, Germany, Austria and Sweden) by keeping accounting records only in Belgium, where customs duties are paid for all releases for free circulation, wherever occurring. In Italy, customs authorities comply with this regime only partially, in the name of a vague cautiousness. In fact, notwithstanding the many businesses requesting the application of this regime, the Italian customs authorities have not authorized it so far, not even within the national territory (namely, a single customs authorization for the whole Italian territory). In Italy, it is issued only at the regional level. This rejects the underlying concept of a type E warehouse and prevents the operation of warehouses in other Member States. Obviously, such an unjustified position penalizes not only Italian businesses, but also the whole Italian economy: A non-EU multinational enterprise will locate its subsidiary in other Member States, and Italy will lose potential revenues and its share of tax resources (25% of customs duties). Italian businesses cannot use a simplified and flexible warehousing regime, thus losing their competitiveness in respect to North-European rivals. In conclusion, since the ‘virtual warehouse’ arrangement is governed by a Community Regulation, and thus is directly applicable in all the EU, it is to be hoped that Italian enterprises press forward to obtain the recognition of a right that certainly cannot be limited by ‘local’ interpretations, which also infringe - in the broad sense - the four fundamental freedoms of movement at the heart of the new Single Market. GUARANTEE As a rule, the authorization is granted only to those who offer every guarantee protecting customs authorities in respect to the warehouse-keeper’s obligations. This guarantee shall be offered by the principal in accordance with the provisions in force. VAT WAREHOUSING: THE ITALIAN MODEL VAT warehousing is an arrangement of domestic law, which enables better management of customs warehousing under certain conditions. In fact, even though customs warehousing allows - by definition - the suspension also of domestic taxation (VAT and excise duties), the economic operator must explicitly apply for this suspension. In other words, although the warehouse-keeper is authorized for customs purposes, he cannot operate the warehouse de facto also for VAT purposes before informing the customs authorities of his intent. These aspects will be clarified when describing the special Italian arrangement and its relevant operational features. The Italian model has been chosen as the best Community implementation of the opportunities given by the regime, as the Directive intended. Notion and Legal Framework VAT warehousing is a domestic suspensive arrangement of accounting established pursuant to Article 50-bis of Decree-Law (D.L.) No. 331 of 30 August 1993, converted into Law No. 427 of 29 October 1993. This regime enables carrying out transactions concerning the goods placed under VAT warehousing, without their being subject to VAT. VAT shall be applied only at the time of the removal of the goods when a relevant selfinvoice is issued in accordance with Article 17, paragraph 3 of Presidential Decree (DPR) No. 633 of 26 October 1972.

In particular. Article 50-bis, paragraph 4, allows relief from VAT of the following transactions:

|

any other information to identify the goods;

any other information to identify the goods;