Read and translate the article.Active Versus Passive Management: Which Is Better?

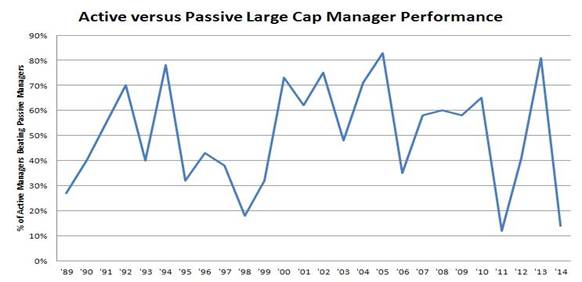

Comment Now Follow Comments Following Comments Unfollow Comments What’s better—active or passive management? Both keep capital markets orderly. Ever since index funds—also known as passive investments–have existed, there has been an endless debate about their merits versus active management. At some point, almost every investor wonders if they have chosen the correct path. This is especially true at extreme points in the market, when one style clearly trumps the other. A great example is November 2014. Most of us heard repeatedly that only 15% of active large-cap stock managers beat their benchmark indexes as the year end approached. Such statistics naturally drive us to question the value of active management. Similarly, there have been periods where active management of large-cap equity funds stunningly outperformed simple indexing. It is no wonder that the debate shows no signs of resolution, and last years’ results further polarize the debate. Have you ever noticed that the two camps are firmly entrenched in their conviction? I hardly know anyone in the grey area when it comes to favoring one philosophy over the other. But I think the truly successful investor would find value in utilizing both approaches in order to optimize potential returns. The concept of passive index investing is relatively new. The first idea of indexing originated in a college senior thesis at Princeton in 1951, but it wasn’t until the early 1970s that the concept gained more academic attention. By then the general public was becoming aware that selective stock pickers often underperformed the market, and investors were at least open to consider other approaches. That led to the first index fund launch in 1976. The public reacted with little fanfare however, and the concept took some time to catch on. By the year 2000, index funds were in full bloom and continue to gain support since then. In contrast to passive management, you may think that active management has been around since the first stock was traded. Although some form of trading existed all the way back to the 1600s, the first stock system that resembles our modern concept probably dates back to the East India Companies. Stock exchanges surfaced about a hundred years later, along with the first primitive attempts at defining research-focused efforts. What we now know as fundamental stock picking really didn’t surface until after the Great Depression. Slowly sprouting “fundamental analysts” gathered facts about the companies, their markets and relative valuations in order to pick the most undervalued securities. It’s also interesting to notice that in 1952—one year after the Princeton thesis about not being able to beat the general market—“modern portfolio theory (MPT)” was born. MPT posits that a fundamental stock picker can offset risk by diversifying stocks in a portfolio. This view has also continued to grow in tandem with the indexing school of thought, and is very much alive today. Today, both philosophies have passionate, stalwart supporters, and many firms on either side of the choice have grown tremendously as a result. This has naturally fueled the intense competition between the two schools, and has created an investment dilemma for many investors. Rather than choose one of these philosophies over the other, I take the unpopular stance of embracing them both, and there are very good reasons to do so. Let me explain how I came to this position. Take a look at the following graph, which shows schematically what percentage of active managers outperformed the passive S&P 500 index investor.

Clearly there is some type of vague cyclicality here. There seems to be a horizontal line at 45% around which the graph oscillates. At some points such as March 2005 to March 2006, and again in March 2009 to March 2010, a high percentage of managers outperform the S&P. On the other hand, these periods of strong outperformance are followed by sudden drops in performance. That is, the passive investor beat the active stock picker. I’m proposing the following behavioral reasons for the cyclicality: Picture many highly skilled analysts all competing to obtain and synthesize relevant information on a stock before everyone else. So many are working so hard, that it is difficult to uncover valuable information before others. At the extreme point, where all information is known by all hard-working analysts, there is virtually no advantage to staying in the game if you’re hoping to gain an information edge. Ironically, staying–and expecting not to gain an information edge–would ensure that no one else gains the information either. If all keep working as hard as possible and none drop out, active management has no edge. With no information edge, indexing begins to look like an appealing alternative and may very well be outperforming active management. But what if some participants become discouraged from the lack of return on their efforts, and they drop out of the active circle and choose to index? That creates the opportunity for the other active die-hards that haven’t given up. I propose that this dynamic is behind the cyclical shifts of active versus passive performance: When market participants become frustrated by the lack of outperformance of active management, some exit the active arena, choosing instead to index. That very exit from the active arena sets the stage for the remaining active managers to outperform. The siren song of active outperformance then lures those participants back in the game. But when everyone piles into active management, the ability to gain an information advantage diminishes, causing the cycle of switching back to passive again. And thus the cycle continues. In an odd way, one could argue that the oscillations between active and passive promotes a type of market stability. Examine the graph again, this time keeping my theory in mind. I’m sure you will see the pattern makes more sense. When considering the choice of active versus passive, a more reasonable answer is to open your mind to both alternatives, not just one.

|

Peter Andersen, Contributor

Peter Andersen, Contributor