In-the-Money and Out-of-the-Money

Selling or writing опционные контракты involves the обязательство either to deliver or to buy assets, if the buyer погашает опцион – chooses to make the trade. For this the seller (writer) receives a fee called премия по опциону from the buyer. But продавцы опционов do not expect them to be exercised. For example, if you expect the цена акции to rise from 100 to 120, you can buy a опцион колл giving the right to buy the stock at 110. If the stock price не повысится to 110, you will not погасите the option, and the продавец опциона will gain the premium. Your option will be без денег, as the stock is trading at ниже цены страйк or exercise price of 110, the price stated in the option. If с другой стороны, the цена акции rises above 110, you are вденьгах: you can исполнить опцион and you will gain the разница between the текущая рыночная цена and 110. If the market moves in an unexpected direction, the продавцы опционов can потерять enormous суммы денег. 9.5.4 Text for discussion. a. Look up the dictionary or Unit 9 Glossary for the meaning and pronunciation of the following words and word-combinations and use them to discuss the problems outlined in the text. To exercise an option; options trading broker; chain of events; resolution of an options contract; cease to exist; exercise request; Options Clearing Corporation or OCC; exercise notice; random selection; the underlying stock; account holders; assignees. b. Briefly scan the text and outline the list of major points . c. Read the text more carefully and comment on the following items using the information given in Fig. 1: - the whole chain of events leading to the eventual resolution of an options contract; - the importance of the Options Clearing Corporation or OCC and its functions; - the reasons for using the random selection method in the process of clearing.

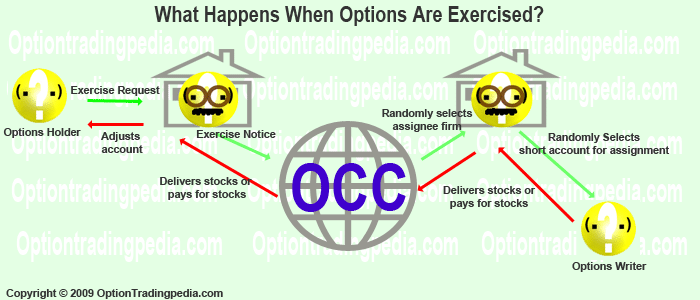

What Happens When an Option is Exercised? When you exercise an option, a request is sent to your options trading broker that sets off a whole chain of events leading to the eventual resolution of an options contract that will cease to exist after that. When the exercise request is received by your options broker, that request to exercise an option is sent to the Options Clearing Corporation or OCC in the form of an "Exercise Notice". The Options Clearing Corporation is the entity responsible for ensuring that all options contracts are successfully settled when exercised and is the biggest clearing organization in the world for financial derivative instruments. Once the exercise notice is received by the OCC, the OCC will randomly select a member firm that is short on that same options contract being exercised for assignment. The selected firm then fulfills the terms of the options contract by delivering the underlying stock if it is a call option being exercised or by paying for the underlying stock if it is a put option that is being exercised. After that, the selected firm selects one or more of its account holders who are short on that same options contract for assignment. The delivery of the stocks or the paying for the stocks by the firm would come from these selected assignees. Every broker or firm would have their own procedure for selecting accounts for assignment but the most commonly used method is random selection. This whole complex process takes place all within just a few minutes with the net result reflected in your account.

|