Sample answer.

a) All characteristics of this economy seem to be within the normal limits, except one – the rate of inflation appears to be too high.

b) To bring the inflation down the Fed must use a contractionary monetary policy. If it decides to engage in open market operations then the appropriate action would be to sell bonds. Doing this would result in a reduction in the money supply and, as the following graph indicates, push the interest rate up.

(M/P)

The decline in investment brought about by this rise in the interest rate would decrease the aggregate demand causing both prices and output to fall (see the graph below):

AD2

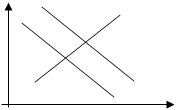

Y2 Y1 Y With decreased output firms will need less labor and therefore employment will decrease as well. c) The monetary policy will be ineffective if investment demand is not sensitive to changes in the interest rate or, conversely, if the demand for money is excessively responsive to changes in the interest rate. d) Increasing personal income taxes would reduce consumption demand causing a leftward shift in the aggregate demand curve:

AD2

Y2 Y1 Y Just like in the case of the contractionary monetary policy described above, this fiscal policy will produce a decrease in output and employment and make the price level go down. With a lower level of output people will need less money to go about their activities. Hence, the demand for money will decrease resulting in a drop in the interest rate. Furthermore, since the output contraction will be accompanied by declining prices, the supply of real balances will increase making the interest rate fall still more.

(M/P)

e) The fiscal policy will be ineffective if the investment demand is very responsive to changes in the interest rate. In this case, even a slight decrease in the interest rate will encourage more investment almost completely offsetting the contractionary effect of the increase in personal income taxes.

Problem 5 (APT’99, P1)

Following an increase in the demand for money, an open economy is experiencing a significant increase in real interest rates relative to the rest of the world.

(i) Explain how this increase will affect each of the following for the country. (i) Investment (ii) The international value of its currency (iii) Exports (ii) Using a correctly labeled aggregate demand and aggregate supply diagram, show how the change in investment you identified in part (a) will affect each of the following in the short run. (i) Output (ii) The price level (iii) Identify one fiscal policy action that could counter the effects identified in part (b). Explain how this policy will affect each of the following. a) Output b) The price level c) Nominal interest rates d) The price of bonds (iv) Identify one monetary policy action that could counter the effects identified in part (b). Using a correctly labeled market graph, show how this policy will affect nominal interest rates.

Sample answer: (a) i) Since investment demand is negatively related to the real interest rate (the higher the interest rate, the greater number of investment projects become unprofitable) when the real interest rate increases investment falls. ii) A higher interest rate will attract capital inflow from abroad. This will lead to an increase in the demand for the domestic currency and cause it to appreciate. iii) The increased value of the domestic currency means that goods produced in this country are now more expensive for foreigners, who will be buying less of them, and as a result exports will decline. (b) Since investment expenditure is part of aggregate demand (AD = C + I + G + NX) its reduction will decrease AD and shift the AD curve to the left. As the following graph illustrates this will lead to a fall in both real output and price level.

P AS

P0 P0

AD1

Y1 Y0 Y

(c) i) and ii): To counter the effects of a decrease in AD the government should use expansionary fiscal policy such as a cut in taxes or an increase in public expenditure. Such a policy will shift the AD curve up resulting in a higher level of output and higher prices. iii) Nominal interest rates will go up for two reasons. First, with increased public expenditure or reduced tax revenues, the government will have to increase its borrowing to finance its spending, the demand for funds will rise pushing the interest rates up (both real and nominal). Second, a higher output we identified above means that people will need more money to go about their activities, therefore, the demand for real balances will increase putting an additional upward pressure on nominal interest rates.

i1

iv) The price of bonds will fall because, on the one hand, the supply of bonds increases, as the government is seeking ways to finance its expansionary fiscal policy and, on the other hand, the increased interest rates on other assets will reduce the demand for bonds bidding their price down. (d) An alternative way to boost aggregate demand would be to implement expansionary monetary policy, such as a reduction in reserve requirements. This action would lead to an increase in the money supply and, as the following graph shows, to lower interest rates:

Inflation.

Problem 1 (APT’95, P3)

Explain how some individuals are helped and others harmed by unanticipated inflation as they participate in each of the following markets.

(a) Credit markets (b) Labor markets (c) Product markets

Sample answer:

(a) In general, the ones who lose from unanticipated inflation are those who are to be paid for the goods or services already delivered and, conversely, the ones who benefit are those who pay. In the case of credit markets, the way in which the repayment of the debt is to take place (including the interest rate) is usually negotiated in advance. Hence, should any unanticipated increase in prices occur, the debtor will sure win as the real value of the amount, he or she is obliged to pay off, decreases. The creditor, by contrast, suffers a loss as unexpected inflation deteriorates the real return on the loan. (b) In labor markets, job contracts are usually signed for relatively long periods of time, which makes nominal wages rather sticky. Thus, when prices rise unexpectedly workers suffer a reduction in the real wage rate and have no choice but to wait until the next job negotiations. The benefit to employers from unexpected inflation can be described in two ways: on the other hand, the real value of the wage they have to pay to their employees goes down, and, on the other, their profits increase, as revenues move in line with the general price level, while the costs are relatively inert and therefore change much slower. (c) Unanticipated inflation constitutes a problem only when a payment is planned to take place at some later date but the size of the deal is already agreed upon. In this case any change in the price level can affect the real value of the amount to be paid thus redistributing wealth between the parties involved. In product markets, however, most payments are made on the nail, so that it does not make much difference what has been recently happening to prices. The only two exceptions are credit sales and the so-called forward contracts (i.e. when two parties stipulate the conditions of a sale that is to take place in the future). The former are a particular case of the aforementioned operations in the credit market and everything that has been said in part (a) applies to them equally well. Thus, what is left to explain is the nature of forward contracts and how they are connected to inflation. The whole point of such sales is to predict as accurately as possible the behavior of prices and basing on this prediction secure the most profitable conditions of the deal. Unanticipated inflation, however, can mess the plans of one of the parties. If prices rise above normal expectations, the seller, who initially considered it a good bargain, would rather cancel it now and sell his product to someone else at a higher price. The buyer, by contrast, is benefited, as he or she gets the product at a lower price than the one which prevails in the market after inflation.

Open Economy: Balance of Payments and Exchange Rate.

Problem 1 (APT’93, P3)

Assume that in the United States, nominal wages rise faster than labor productivity. Analyze the short-run effects of this situation on each of the following.

(a) The general price level (b) The level of exports (c) The international value of the dollar

Sample answer:

(a) The fact that nominal wages rise faster than labor productivity implies that aggregate supply curve shifts up (the positive effect of increasing productivity is outweighed by the negative effect of higher wage costs). As depicted in the following graph, this situation will result in an increase in the general price level:

AD

Y (b) Increasing prices make American products relatively more expensive and therefore less attractive to foreign consumers. Consequently, demand for domestically produced goods will decline causing a decrease in the country’s exports. (c) With decreased exports foreigners will need less dollars to pay for the goods they buy from the United States. Thus, demand for domestic currency will go down resulting in depreciation of the dollar:

International value of the dollar

D1

Q2 Q1 Quantity of dollars

Problem 2 (APT’94, P3)

Assume that United States labor becomes more productive because of major technological changes.

I. Using the aggregate supply and aggregate demand model, explain how the increased productivity will affect each of the following for the United States.

(a) Output (b) Price level (c) Exports

II. Explain how the change in exports you identified in (c) will affect the international value of the dollar.

Sample answer:

I. If labor becomes more productive, the aggregate supply curve will shift to the right indicating the increased ability of firms to produce more goods with the same resources:

AD

Y1Y2 Y

As we observe in the above diagram, the technological improvement will bring about (a) an increase in output and (b) a decrease in the price level. (c) The reduction in domestic prices will make indigenous goods relatively cheaper, and therefore more competitive, thus increasing foreign demand for the country’s exports.

II. Provided that the demand for the United States exports is price elastic, so that the total value of exports increases when prices fall, the demand for domestic currency will go up (foreigners will need more dollars to pay for the goods they buy from the United States). This, as the following graph shows, will induce the dollar to appreciate:

|

i MS2 MS1

i MS2 MS1

i2

i2 i1 MD

i1 MD

P

P SAS

SAS

P1

P1

P2 AD1

P2 AD1

i1

i1 MD1

MD1

P1 AD0

P1 AD0

i

i

(M/P)S

(M/P)S

i2 MD

i2 MD (M/P)

(M/P)

i (M/P)S

i (M/P)S

i0

i0 i1 MD

i1 MD (M/P)

(M/P)

AS1

AS1

P2

P2 P1

P1

S

S

E1

E1

E2

E2 D2

D2

AS1

AS1 P AS2

P AS2

P1

P1 P2

P2