UNIT 30

BANKS Task 1. Read the text and write out unknown words TYPES OF BANKS AND THEIR SERVICES

Banking is the business a bank is engaged in. There exist different types of banks but their names may vary from one country to another. Central banks such as the National Bank (Ukraine), the Bank of England (UK) or the Federal Reserve System (US) look after the government's finance and monetary policy, act as bankers for the state and for commercial banks, and are responsible for issuing banknotes. Commercial banks deal directly with the public. They offer a wide range of services such as accepting deposits, making loans and managing customers' accounts. The aim of commercial banks is to earn profit Merchant banks don't deal with the public. They provide services for companies. They specialize in raising capital for industry, arranging flotations, takeovers and mergers, and investment portfolios. Investment banks are firms that control the issue of new securities (shares and bonds). Savings banks are financial institutions that specialize in providing services such as savings accounts as opposed to general banking services. Banker's services cover an enormous range of activities today. A full list would include: Current account services. They are extended to anyone whom banks regard as reliable. A new depositor should be recommended by his employer or should present a reference. If this proves satisfactory the bank will accept a deposit from him which will be entered in his current account. A cheque book will then be issued free of charge. Once the customer has received his cheque book he may use the cheques to order the banker to pay out sums of money from his current account. Money is being paid into and paid out of the account as often as the customer finds convenient. Deposit account services. Companies and individuals can deposit cash resources that are not needed at present. They can withdraw the money either any day they need it or after a certain period in case of time deposits. Savings account services. It enables small savers to put money away for particular purposes, for example for holidays. Other services: foreign exchange foreign exchange transactions services in foreign trade payments discounting bills of exchange

investment management services cash dispensers and automated teller machines safe custody economic information banker's credit cards and many others

Task 2. Give the English for установа, яка має справу з грошами надавати фінансові послуги банківська справа Національний банк України піклуватися про монетарну політику відповідати за емісію грошей комерційний банк приймати депозити надавати позику заробляти прибуток торговельний банк придбання контрольного пакета акцій злиття (підприємств) інвестиційний банк ощадний банк ощадний рахунок банківські послуги пропонувати багато послуг клієнтам запроваджувати нові послуги кредитна картка купувати товари емітент кредитної картки розраховуватися за позику перевищення кредиту на банківському рахунку здійснювати платіж переказувати гроші пряме дебатування постійне доручення іноземна валюта страхування

Task 3. Match words from list A with words from list В that have a similar meaning

Task 4. Find suitable opposites to the following words and phrases definite to control to lose profit commercial banks withdrawal

Task 5. Find explanation that mean bank book, bank manager, bank clerk, bank draft, bank charge, bank account, bank deposit, bank statement, bank loan, bank holiday 1. a book that lists all payments into and withdrawals from a customer's bank account 2. the amount of money paid by a customer to the bank for its services 3. a person who serves customers, keeps accounts and does other work in a bank 4. a sum of money left with a bank for safe keeping or to earn interest 5. a cheque that guarantees payment by a bank 6. money that has been lent by a bank to a customer for a fixed period 7. a person employed by a bank to control a particular branch or department 8. (UK) a day, not a Saturday or Sunday, when banks are closed and which is also a general holiday 9. an arrangement with a bank that allows the-customer to pay in and take out money 10. a printed report that shows all the money paid into and out of a customer's bank account within a certain period and the total amount left in the account

Task 6. Look at the words and phrases. Match them with the correct definition from the list below flotation, loan, deposit, bank, merchant bank, Federal Reserve System, banking, savings bank, savings account, central bank, investment bank, commercial bank 1. the business of running or working in a bank 2. the most important bank in a country because it issues and manages currency and helps to carry out the government's financial policy 3. a bank that provides many different services for its customers, e.g. providing bank accounts and credit cards, arranging loans, etc. 4. a bank that specializes in raising capital for industry. It advises companies on flotations, manages investment portfolios 5. a bank that provides finance for companies, especially by buying stocks and securities and selling them in smaller units to the public 6. a financial institution that specializes in providing services such as savings accounts 7. an organization that holds money, important documents and other valuables in safe keeping, and lends money at interest 8. a sum of money paid into a bank or savings account 9. an account with a bank for personal savings 10. something lent, usually money, on the condition it will be paid back after an agreed period with interest 11. the central banking system of the USA 12. offering company shares for sale to the public or on a stock exchange for the first time

Task 7. Write the appropriate word or phrase in the following spaces. Translate the sentences into Ukrainian 1. She opened her................................................... with the Midland Bank last year. 2. She works in..................................................... 3. Her monthly salary was paid into the.......................................................... 4. I made a...................................................... at the bank this morning. 5. I applied at the bank for a............................................. at 7% interest. 6. Lloyd's is one of the major..................................................... banks in the UK. 7. The firm has taken advice from a................................................ bank on the flotation. 8. I put $600 in my.................................................... account last year and earned 5 percent annual interest. 9. The company has had a difficult time since its................................................. in 2001. 10. The company decided to increase its.................................................... and bought shares in Smith. Ltd. 11. A............................................... card allows you to buy goods and pay for them later. Portfolio; flotation; savings; merchant; commercial; loan; deposit; bank; banking; account, credit.

Task 8. Fill in the missing prepositions The central bank.................. the UK has a number..................... important functions..................... the economy. It is the government's bank, which means that it issues and refunds government loans and securities and looks.......................... the National Debt. It is the only bank allowed to issue bank notes..................... England and Wales. It implements the monetary policy...................... the government..................... its control.................... the money supply and interest rates. It also controls the provision............... international exchange................ trading. It is a publicly owned organization, largely controlled....................... the Treasury. (of (4), in (2), after, through, over, for, by)

Task 9. Answer the following questions

2. What is banking? 3. What types of banks exist in most countries? 4. What functions do central banks perform? 5. What kind of institution is a commercial bank? 6. What is the difference between a national bank and a commercial bank? 7. Who are the clients of a merchant bank? 8. What do merchant banks specialize in? 9. What are investment banks? 10. What is characteristic of a savings bank (as opposed to a merchant bank)? 11. What are the potential advantages of large banks? 12. What is the Federal Reserve System?

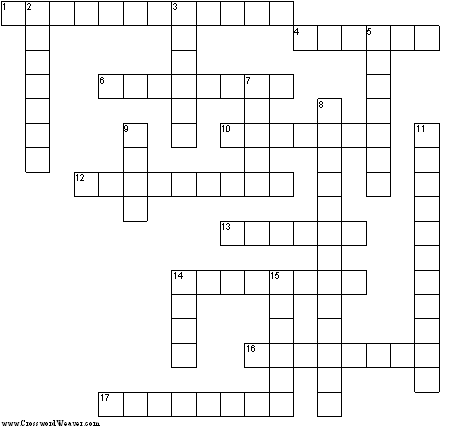

Task 10. Translate into English 1. Банк - це установа, яка має справу з грошами та надає різні фінансові послуги. 2. Банківська справа - це бізнес, яким займається банк. 3. Нацбанк України піклується про державні фінанси та монетарну політику. 4. Центральні банки відповідають за емісію грошей. 5. Головна мета комерційного банку - одержання прибутні 6. Торговельний банк надає послуги компаніям. Він не працює з населенням. 7. Інвестиційний банк - це фірма, яка контролює випуск нових цінних паперів. 8. Ощадний банк спеціалізується в наданні таких послуг, як ощадні рахунки. 9. Комерційні банки це головна ланка в кредитній системі держави. 10. Федеральна резервна система, яка включає 12 федеральних банків та їх філії, контролює американську державну банківську систему. Task 11. Complete the crossword

Task 12. f ind the words below in the grid. Words can go horizontally, vertically and diagonally, backwards or forwards

|

A bank is an institution that deals in money and provides other financial services. Banks are at the heart of any financial system.

A bank is an institution that deals in money and provides other financial services. Banks are at the heart of any financial system. granting loans

granting loans 1. What is the bank?

1. What is the bank?