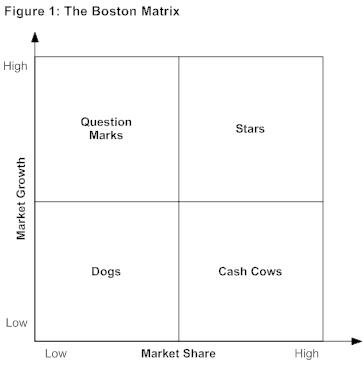

The Matrix Itself

The Boston Matrix categorizes opportunities into four groups, shown on axes of Market Growth and Market Share:

Similarly to the Ansoff Matrix, with Boston Matrix it is also very difficult to decide where my business- “Victorio Cakes” should go to. For instance, it cannot go to the ‘Stars’ cell, because it includes large businesses with high growth, which have very big budgets, compete heavily with the other firms on the market and invest a lot of money into their development, in order to gain as much shares in the market in order to dominate. From this it can, therefore, be seen that “Victorio Cakes” aim is clearly different from what those firms that are in the ‘Stars’ cell. Also, “Victorio Cakes” cannot be put into the ‘Cash Cows’ cell, because this cell is for firms that are very similar to those in the ‘Stars’ cell, but with a much lower rate of growth, and they need a lot of investments in order to keep themselves going and preventing losing a share on the market they are at. These firms tend to be very large, also with huge budgets, which “Victorio Cakes” isn’t. Neither “Victor Cakes” fits into the ‘Dogs’ cell, because it doesn’t go into the category of those firms that are not really worth investing into, where firms have very low shares on the market with a low growth or very niche market. Such businesses can still make some profits, but they will be relatively low, and just covering the break-even point or total costs of the production. The cycle of such firms is not very long, and they usually exist for a certain period of time until they reach the point of penetration of the market or see no interest or very low demand for their goods and services, which forces them to bankrupt or close down. “Victorio Cakes” clearly isn’t that type of business. One of the cells that “Victorio Cakes” is most close to fit into, is ‘Question marks’, because it involves such firms and businesses that have relatively low share on the market they are at, have relatively limited budgets, and exist in the highly growing markets, where a certain degree of investment is needed, in order for such businesses to be competitive in relation to the other firms on the market.

Dogs - Unsurprisingly, the term "dogs" refers to businesses or products that have low relative share in unattractive, low-growth markets. Dogs may generate enough cash to break-even, but they are rarely, if ever, worth investing in. Using the BCG Box to determine strategy Once a company has classified its SBU's, it must decide what to do with them. In the diagram above, the company has one large cash cow (the size of the circle is proportional to the SBU's sales), a large dog and two, smaller stars and question marks. Conventional strategic thinking suggests there are four possible strategies for each SBU: (1) Build Share: here the company can invest to increase market share (for example turning a "question mark" into a star) (2) Hold: here the company invests just enough to keep the SBU in its present position (3) Harvest: here the company reduces the amount of investment in order to maximise the short-term cash flows and profits from the SBU. This may have the effect of turning Stars into Cash Cows. (4) Divest: the company can divest the SBU by phasing it out or selling it - in order to use the resources elsewhere (e.g. investing in the more promising "question marks").

|