Table 8. Mostotrest’s Corporate Segments

Source: Company data; A-Team analysis

|

Source: Company data

Mostotrest (MSTT)is the main entity of the group through which the majority of operations are carried out. Its business mainly deals with engineering, construction and renovation of road and rail bridges and highways. By the end of 2011, Mostotrest accounted for 50% of the group’s combined revenues and 60% of the backlog (Figures 4&5).

The Company works on projects both in a capacity of a general contractor and as a subcontractor, and predominantly operates in economically prosperous regions like the Central Federal District (FD) inc. Moscow, Southern FD and Volga FD (Appendix K).

Engtransstroy (ETS)is a company with extensive expertise in project management and turn-key implementation of transport infrastructure facilities of any complexity across all the major segments of the market. In 2011 ETS accounted for 37% and 13% shares in the Group’s combined revenues and backlog respectively (Figures 4&5).

ETS operates as a pure general contractor bidding for large-scale projects and redistributing them further to its subcontractors. The company is headquartered in the Central FD and has branches in the North-Western, Southern and Far East Federal Districts (Appendix K).

The acquisition of ETS has not only further expanded the geographical presence of Mostotrest, but also enabled it to strengthen its general contractor expertise and gave it an access to new market segments inc. the ports and railway infrastructure facilities construction.

Transstroy-Mechanisatsiya (TSM) is a company mainly involved in construction and overhaul of bridges and highways as well as of airport infrastructure facilities. In 2011 TSM accounted for 27% and 13% in the Group’s revenue and backlog (Figures 4&5).

TSM operates in a number of locations inc. the Central, Southern and Far East Federal Districts. It performs the construction works predomonantly as a subcontractor for ETS, but is also expanding its general contractor capabilities.

From the strategy prospect, the acquisition of TSM further expanded Mostotrest’s geographic presence in investment-rich regions like Sochi in the Southern FD and Vladivostok in the Far East and enhanced the scope of its operations strengthening its bridges and highways construction capabilities and giving the access to airports infrastructure segment.

Mostotrest also holds a 25% equity interest in Mostostroy-11, Surgut-based company with extensive technological and engineering expertise. Its core activities include construction and repair of automobile, railway and city bridges as well as other industrial and civil construction. The company operates through its 8 branches in the Urals and Southern Federal Districts expanding the Group’s geographic presence and further strengthening its position in the market.

North-West Concession Company (NWCC)is the concessionaire of Moscow-St. Petersburg Highway set up by Vinci SA. Mostotrest has recently acquired a 50% stake in NWCC in order to diversify into the segment of concessions as well as to benefit from the partnership with a leading infrastructure construction company, Vinci.

Natsionalnaya Industrialnaya Torgovaya Palata (NITP) is a road maintenance and repair company where Mostotrest holds a 60% equity stake. The company complements Mostotrest’s core business and enables it to bid for emerging life cycle contracts that involve construction and subsequent maintenance and repair of infrastructure facilities. This is also in line with Mostotrest’s strategy of diversification into related market segments.

United Toll Systems (UTS) is a joint venture set up in partnership with Kapsch Group, leading toll collection systems developer. UTS is engaged in the repair, maintenance and toll-based operations of a segment of the M4 “Don” Highway further diversifying the Group’s operations into related segments as part of its long-run strategy.

ON-SITE PRODUCTION FACILITIES AND SUPPLIERS

Each regional branch of MSTT has its own production facilities that enable it to produce particular materials used in construction inc. concrete, cement and sand mix as well as engineering structures such as precast concrete, reinforced concrete structures and steel structures. TSM also has capacities to produce concrete and cement. For production of more sophisticated engineering metal structures, Mostotrest deploys its two factories “Mokon” (Moscow) and Mekhstroymost (Tula). The Company’s capacities supply almost a third of the materials necessary for operations (Table 1 & Figure 7).

The rest of raw materials and engineering structures is purchased on a centralized basis directly from the relevant suppliers (Appendix H). The centralized purchasing system enables MSTT to efficiently monitor the situation in raw materials market and unify its purchasing procedures accordingly.

HIGH PROFILE PROJECTS IN BACKLOG

Mostotrest and its subsidiaries successfully fill their order book with new large-scale projects. As of 1H 2012, the Group had almost RUB300bn worth of projects in its backlog which covers 3x its 2011 revenues. Mostotrest is currently working on a number of projects inc. the construction of Moscow Fourth Ring Road worth RUB60bn, Kurortny Avenue Relief Road in Sochi (RUB50.3bn), two sections of the Moscow-Saint Petersburg Highway (RUB83.1bn) and many others (Appendix L).

CUSTOMER BASE

Mostotrest mainly serves the public sector customers inc. Federal State agencies, regional and municipal authorities as well as state-related corporations and private customers through emerging Public Private Partnership projects. As of 1H 2012, the state customers accounted for over 80% of the Group’s backlog (Figure 8). For more detail on customers see Appendix I.

DEVELOPMENT STRATEGY

Mostotrest has been vigorously executing its long-term strategy which contributed dramatically to its successful development. In order to retrain its leading positions, Mostotrest is committed to further leveraging its technological expertise to deliver complex projects across all the segments of its operation, strengthening its general contractor expertise and developing in a new segment of the market, namely, construction of tunnels which is deemed highly profitable.

Industry Overview and Competitive Positioning

The transport infrastructure construction industry in Russia has experienced a decade of strong growth amidst the abundant government spending. From 2000 to 2010 Russia’s spending on inland transport infrastructure development averaged 1.4% of GDP a year. In 2010 the country’s spending was 40 bps higher than the average spent by other member countries of the International Transport Forum (ITF), according to OECD (Figure 9).

Demand for transport infrastructure construction works has been high with the market estimated at RUB660bn in 2011. Almost 60% of the spending was directed to construction of bridges and roads (Figure 11). During pre-crisis years the infrastructure construction market was growing faster than the economy as a whole, while in 2009 it took a weaker hit than the economy (Figure 10).

The market is expected to grow further as the government is determined to rebuild and renovate the transport infrastructure, which, due to its extremely poor state does not meet the country’s requirements. It is estimated that the economy loses up to 3% of GDP annually in the form of unearned revenue and damaged competitiveness of goods due to abnormally high transportation costs, which, according to the Ministry of Transport (MinTrans) make up on average 20-25% of the output costs while in countries with a well developed transport infrastructure that is only 7-8%. So it became a state priority to develop the transport infrastructure as the one in its current state undermines the country’s economic development. In the Global Enabling Trade report prepared for the World Economic Forum 2012, Russia was ranked low for the quality of its transport infrastructure (Table 2 & 3). Below is a brief analysis of the key transport infrastructure elements.

Roads.The major problem with roads is that they are insufficient, highly depreciated and overloaded as a result. According to Russian Statistics Agency (Rosstat), In 2011 there was 1,094 th km of roads out of which 20%was unpaved, and 35% required repair. In comparison with 1995, road network added just 16% severely lagging behind the surge in car ownership with the number of passenger cars growing 142% which significantly strains the country’s transportation system. As the roads accounted for almost 70% and 80% of cargo and passenger transportation, it is vital to upgrade and extend the existing network.

Railways.While in terms of length the railway network is fairly well developed counting 85,292 km of lines, the quality of the railway transportation services leaves much to be desired as about 59% of the railways are depreciated and require upgrade. That, in turn, has a twofold implication: on the one hand it results in lower efficiency of the railway transportation itself, and, on the other hand puts additional pressure on the road network as the increasingly higher number of commercial shipment is made by means of roads due to unsatisfactory and untimely railway services. According to BCG, in 2011 the mining industry alone could have failed to realize as much as $4.5bn worth of produce because of the railway system’s inability to meet the industry’s transportation needs which undermines the country’s export potential.

Sea ports and Inland waterways.In addition to having insufficient sidings, limited throughput capacity and being on average 70% depreciated, the majority of Russian sea ports lack deep water harbors which makes it impossible to service high-tonnage ships. For example, the Trade Sea Port of Kaliningrad is currently being used at just 35% capacity as it cannot service ships with a draught deeper than 9 meters, given that the most commonly used ships like Aframax and Post-Panamax require harbors of at least 15 meters in depth. This altogether results in lower volume of trade and over RUB220bn will be invested in sea ports development as part of the Federal Target Program (FTP) with private companies already actively investing in renovation of sea ports. The inland waterway infrastructure is also in need of a complete overhaul as the majority of facilities were build in 1950-60s and were never renovated since then.

Airports and airfields. With the airline passenger traffic increasing dramatically over the past decade Russia is becoming short of runways as the major airports operate at their full capacity. Given that over 60% of the country’s territory lies in the regions of Extreme North where the only acceptable means of transport is aviation, it is important to develop the appropriate infrastructure, and, in fact, over RUB1,250bn is allocated for this purpose within the FTP.

Underpinned by the current situation, demand for infrastructure construction services will continue to be high as Russia will need to spend 2-2.5% of GDP by 2020 in order to fix the problem according to MinTrans, while the international events such as the 2014 Winter Olympics and the 2018 FIFA World Cup and entry to WTO meant to boost trade will put extra pressure on transportation system calling for extensive build out and upgrade of transport infrastructure. And, in fact, a number of determined steps have been taken including the launch of the Federal Target Program ‘Development of the Transport System’ under which RUB13.5tn. Is planned to be invested in infrastructure between 2010 and 2015. We expect the market to grow at a 12.6% CAGR during 2012-2017.

SIGNIFICANT INDUSTRY TRENDS

Over the past few years the industry experienced a number of trends that have impacted its operating environment strengthening the position of large and integrated companies like Mostotrest. Among those changes was the move from tendering numerous small and fairly straight-forward projects to tendering more complex and aggregate ones as was seen through the average industry contract size more than tripling to RUB3.2mn over the past 4 years. Another significant development was the introduction of life cycle projects that involve the construction and subsequent repair and maintenance of infrastructure facilities awarded to a single company. These projects are seen attractive as they ensure guaranteed income to the operator company and, in fact, Mostotrest won both of the projects of this type tendered in 2011. The industry also saw the emergence of alternative financing sources like Private Public Partnerships (PPP) which enable private sector investors to build infrastructure facilities and subsequently operate them for revenue over a specified period. PPPs are not only beneficial to the government helping it to ease its financial burden, but are also beneficial to construction companies in diversifying their customer base.

COMPETITIVE POSITIONING

The transport infrastructure construction market in Russia is very fragmented as it is worldwide. The companies operating in this market can be broken into 3 tiers: small-size regional companies capable of performing simple construction and repair works, medium-size companies implementing reasonably complex projects with focus on a limited range of works, and top-tier companies like Mostotrest operating on a national scale with established track record in implementing large-scale and technologically complex projects in a number of segments.

The top-tier companies operate in their own environment with significant entry barriers in the form of reputation, scale, and financial recourses. We take a closer look at these companies, direct competitors of Mostotrest.

PSK Transstroy is the second largest company holding 4% of the market. Originally part of the USSR Ministry for Transport Construction, Transstroy was reorganized as a state corporation in 1991 and was later privatized in 2007. The company has strong expertise in engineering and design of transport infrastructure and is predominantly involved in construction and overhaul of highways, bridges and airport runways.

DSK Avtobanis a company mainly specialized in construction of highways and bridges with some operations in other segments. It has a market share of 4% and is located in Krasnodar region. In addition to operating in the Sothern part of Russia the company covers a number of other locations.

SK Most has a 3% market share and specializes in construction of bridges, interchanges, tunnels and airport infrastructure facilities. It has a particularly strong expertise in construction of railway, traffic and metro tunnels. In 2012 the company was acquired by an oil trader, Gennady Timchenko, whose assets also include a Moscow-based construction and transport services company ARKS.

NPO Mostovik designs and constructs highways, bridges, railways and tunnels and holds a 3% share in the broad infrastructure construction market. Mostovik is the main competitor of Mostotrest in the bridges construction segment. According to PMR report, in 2009 the company held a 6% share of the bridges segment, while Mostotrest’s controlled the largest share of 25%. Mostovik has a broad exposure to various projects related to the 2014 winter Olympics in Sochi.

Even though the competition among major companies is fairly tough, Mostotrest as the industry leader is well positioned in the market and has a number of advantages that will enable it to strengthen its position further acquiring higher market shares. We see Mostotrest’s competitive advantage in its:

§ Integrated business model and presence in all of the key market segments

§ Best technological expertise in construction of bridges, the most complex element of transport infrastructure

§ Reliable general contractor reputation with proven track record of delivering complex projects

§ Wide geographic presence covering the most attractive regions in terms of anticipated investments

§ Strong financial position and opportunities for further expansion

Investment summary

Mostotrest started 2012 trading at RUB190 a share reaching its peak of RUB213 upon the announcement of 2011 IFRS results in mid April. The successful performance for the year boosted investor sentiment, however, the shares took a downward trend since then. This is, in our view, due to lower post-IPO trading liquidity which puts a discount on the stock as investors seek to compensate for additional risk.

Source: Company data

Mostotrest (MSTT)is the main entity of the group through which the majority of operations are carried out. Its business mainly deals with engineering, construction and renovation of road and rail bridges and highways. By the end of 2011, Mostotrest accounted for 50% of the group’s combined revenues and 60% of the backlog (Figures 4&5).

The Company works on projects both in a capacity of a general contractor and as a subcontractor, and predominantly operates in economically prosperous regions like the Central Federal District (FD) inc. Moscow, Southern FD and Volga FD (Appendix K).

Engtransstroy (ETS)is a company with extensive expertise in project management and turn-key implementation of transport infrastructure facilities of any complexity across all the major segments of the market. In 2011 ETS accounted for 37% and 13% shares in the Group’s combined revenues and backlog respectively (Figures 4&5).

ETS operates as a pure general contractor bidding for large-scale projects and redistributing them further to its subcontractors. The company is headquartered in the Central FD and has branches in the North-Western, Southern and Far East Federal Districts (Appendix K).

The acquisition of ETS has not only further expanded the geographical presence of Mostotrest, but also enabled it to strengthen its general contractor expertise and gave it an access to new market segments inc. the ports and railway infrastructure facilities construction.

Transstroy-Mechanisatsiya (TSM) is a company mainly involved in construction and overhaul of bridges and highways as well as of airport infrastructure facilities. In 2011 TSM accounted for 27% and 13% in the Group’s revenue and backlog (Figures 4&5).

TSM operates in a number of locations inc. the Central, Southern and Far East Federal Districts. It performs the construction works predomonantly as a subcontractor for ETS, but is also expanding its general contractor capabilities.

From the strategy prospect, the acquisition of TSM further expanded Mostotrest’s geographic presence in investment-rich regions like Sochi in the Southern FD and Vladivostok in the Far East and enhanced the scope of its operations strengthening its bridges and highways construction capabilities and giving the access to airports infrastructure segment.

Mostotrest also holds a 25% equity interest in Mostostroy-11, Surgut-based company with extensive technological and engineering expertise. Its core activities include construction and repair of automobile, railway and city bridges as well as other industrial and civil construction. The company operates through its 8 branches in the Urals and Southern Federal Districts expanding the Group’s geographic presence and further strengthening its position in the market.

North-West Concession Company (NWCC)is the concessionaire of Moscow-St. Petersburg Highway set up by Vinci SA. Mostotrest has recently acquired a 50% stake in NWCC in order to diversify into the segment of concessions as well as to benefit from the partnership with a leading infrastructure construction company, Vinci.

Natsionalnaya Industrialnaya Torgovaya Palata (NITP) is a road maintenance and repair company where Mostotrest holds a 60% equity stake. The company complements Mostotrest’s core business and enables it to bid for emerging life cycle contracts that involve construction and subsequent maintenance and repair of infrastructure facilities. This is also in line with Mostotrest’s strategy of diversification into related market segments.

United Toll Systems (UTS) is a joint venture set up in partnership with Kapsch Group, leading toll collection systems developer. UTS is engaged in the repair, maintenance and toll-based operations of a segment of the M4 “Don” Highway further diversifying the Group’s operations into related segments as part of its long-run strategy.

ON-SITE PRODUCTION FACILITIES AND SUPPLIERS

Each regional branch of MSTT has its own production facilities that enable it to produce particular materials used in construction inc. concrete, cement and sand mix as well as engineering structures such as precast concrete, reinforced concrete structures and steel structures. TSM also has capacities to produce concrete and cement. For production of more sophisticated engineering metal structures, Mostotrest deploys its two factories “Mokon” (Moscow) and Mekhstroymost (Tula). The Company’s capacities supply almost a third of the materials necessary for operations (Table 1 & Figure 7).

The rest of raw materials and engineering structures is purchased on a centralized basis directly from the relevant suppliers (Appendix H). The centralized purchasing system enables MSTT to efficiently monitor the situation in raw materials market and unify its purchasing procedures accordingly.

HIGH PROFILE PROJECTS IN BACKLOG

Mostotrest and its subsidiaries successfully fill their order book with new large-scale projects. As of 1H 2012, the Group had almost RUB300bn worth of projects in its backlog which covers 3x its 2011 revenues. Mostotrest is currently working on a number of projects inc. the construction of Moscow Fourth Ring Road worth RUB60bn, Kurortny Avenue Relief Road in Sochi (RUB50.3bn), two sections of the Moscow-Saint Petersburg Highway (RUB83.1bn) and many others (Appendix L).

CUSTOMER BASE

Mostotrest mainly serves the public sector customers inc. Federal State agencies, regional and municipal authorities as well as state-related corporations and private customers through emerging Public Private Partnership projects. As of 1H 2012, the state customers accounted for over 80% of the Group’s backlog (Figure 8). For more detail on customers see Appendix I.

DEVELOPMENT STRATEGY

Mostotrest has been vigorously executing its long-term strategy which contributed dramatically to its successful development. In order to retrain its leading positions, Mostotrest is committed to further leveraging its technological expertise to deliver complex projects across all the segments of its operation, strengthening its general contractor expertise and developing in a new segment of the market, namely, construction of tunnels which is deemed highly profitable.

Industry Overview and Competitive Positioning

The transport infrastructure construction industry in Russia has experienced a decade of strong growth amidst the abundant government spending. From 2000 to 2010 Russia’s spending on inland transport infrastructure development averaged 1.4% of GDP a year. In 2010 the country’s spending was 40 bps higher than the average spent by other member countries of the International Transport Forum (ITF), according to OECD (Figure 9).

Demand for transport infrastructure construction works has been high with the market estimated at RUB660bn in 2011. Almost 60% of the spending was directed to construction of bridges and roads (Figure 11). During pre-crisis years the infrastructure construction market was growing faster than the economy as a whole, while in 2009 it took a weaker hit than the economy (Figure 10).

The market is expected to grow further as the government is determined to rebuild and renovate the transport infrastructure, which, due to its extremely poor state does not meet the country’s requirements. It is estimated that the economy loses up to 3% of GDP annually in the form of unearned revenue and damaged competitiveness of goods due to abnormally high transportation costs, which, according to the Ministry of Transport (MinTrans) make up on average 20-25% of the output costs while in countries with a well developed transport infrastructure that is only 7-8%. So it became a state priority to develop the transport infrastructure as the one in its current state undermines the country’s economic development. In the Global Enabling Trade report prepared for the World Economic Forum 2012, Russia was ranked low for the quality of its transport infrastructure (Table 2 & 3). Below is a brief analysis of the key transport infrastructure elements.

Roads.The major problem with roads is that they are insufficient, highly depreciated and overloaded as a result. According to Russian Statistics Agency (Rosstat), In 2011 there was 1,094 th km of roads out of which 20%was unpaved, and 35% required repair. In comparison with 1995, road network added just 16% severely lagging behind the surge in car ownership with the number of passenger cars growing 142% which significantly strains the country’s transportation system. As the roads accounted for almost 70% and 80% of cargo and passenger transportation, it is vital to upgrade and extend the existing network.

Railways.While in terms of length the railway network is fairly well developed counting 85,292 km of lines, the quality of the railway transportation services leaves much to be desired as about 59% of the railways are depreciated and require upgrade. That, in turn, has a twofold implication: on the one hand it results in lower efficiency of the railway transportation itself, and, on the other hand puts additional pressure on the road network as the increasingly higher number of commercial shipment is made by means of roads due to unsatisfactory and untimely railway services. According to BCG, in 2011 the mining industry alone could have failed to realize as much as $4.5bn worth of produce because of the railway system’s inability to meet the industry’s transportation needs which undermines the country’s export potential.

Sea ports and Inland waterways.In addition to having insufficient sidings, limited throughput capacity and being on average 70% depreciated, the majority of Russian sea ports lack deep water harbors which makes it impossible to service high-tonnage ships. For example, the Trade Sea Port of Kaliningrad is currently being used at just 35% capacity as it cannot service ships with a draught deeper than 9 meters, given that the most commonly used ships like Aframax and Post-Panamax require harbors of at least 15 meters in depth. This altogether results in lower volume of trade and over RUB220bn will be invested in sea ports development as part of the Federal Target Program (FTP) with private companies already actively investing in renovation of sea ports. The inland waterway infrastructure is also in need of a complete overhaul as the majority of facilities were build in 1950-60s and were never renovated since then.

Airports and airfields. With the airline passenger traffic increasing dramatically over the past decade Russia is becoming short of runways as the major airports operate at their full capacity. Given that over 60% of the country’s territory lies in the regions of Extreme North where the only acceptable means of transport is aviation, it is important to develop the appropriate infrastructure, and, in fact, over RUB1,250bn is allocated for this purpose within the FTP.

Underpinned by the current situation, demand for infrastructure construction services will continue to be high as Russia will need to spend 2-2.5% of GDP by 2020 in order to fix the problem according to MinTrans, while the international events such as the 2014 Winter Olympics and the 2018 FIFA World Cup and entry to WTO meant to boost trade will put extra pressure on transportation system calling for extensive build out and upgrade of transport infrastructure. And, in fact, a number of determined steps have been taken including the launch of the Federal Target Program ‘Development of the Transport System’ under which RUB13.5tn. Is planned to be invested in infrastructure between 2010 and 2015. We expect the market to grow at a 12.6% CAGR during 2012-2017.

SIGNIFICANT INDUSTRY TRENDS

Over the past few years the industry experienced a number of trends that have impacted its operating environment strengthening the position of large and integrated companies like Mostotrest. Among those changes was the move from tendering numerous small and fairly straight-forward projects to tendering more complex and aggregate ones as was seen through the average industry contract size more than tripling to RUB3.2mn over the past 4 years. Another significant development was the introduction of life cycle projects that involve the construction and subsequent repair and maintenance of infrastructure facilities awarded to a single company. These projects are seen attractive as they ensure guaranteed income to the operator company and, in fact, Mostotrest won both of the projects of this type tendered in 2011. The industry also saw the emergence of alternative financing sources like Private Public Partnerships (PPP) which enable private sector investors to build infrastructure facilities and subsequently operate them for revenue over a specified period. PPPs are not only beneficial to the government helping it to ease its financial burden, but are also beneficial to construction companies in diversifying their customer base.

COMPETITIVE POSITIONING

The transport infrastructure construction market in Russia is very fragmented as it is worldwide. The companies operating in this market can be broken into 3 tiers: small-size regional companies capable of performing simple construction and repair works, medium-size companies implementing reasonably complex projects with focus on a limited range of works, and top-tier companies like Mostotrest operating on a national scale with established track record in implementing large-scale and technologically complex projects in a number of segments.

The top-tier companies operate in their own environment with significant entry barriers in the form of reputation, scale, and financial recourses. We take a closer look at these companies, direct competitors of Mostotrest.

PSK Transstroy is the second largest company holding 4% of the market. Originally part of the USSR Ministry for Transport Construction, Transstroy was reorganized as a state corporation in 1991 and was later privatized in 2007. The company has strong expertise in engineering and design of transport infrastructure and is predominantly involved in construction and overhaul of highways, bridges and airport runways.

DSK Avtobanis a company mainly specialized in construction of highways and bridges with some operations in other segments. It has a market share of 4% and is located in Krasnodar region. In addition to operating in the Sothern part of Russia the company covers a number of other locations.

SK Most has a 3% market share and specializes in construction of bridges, interchanges, tunnels and airport infrastructure facilities. It has a particularly strong expertise in construction of railway, traffic and metro tunnels. In 2012 the company was acquired by an oil trader, Gennady Timchenko, whose assets also include a Moscow-based construction and transport services company ARKS.

NPO Mostovik designs and constructs highways, bridges, railways and tunnels and holds a 3% share in the broad infrastructure construction market. Mostovik is the main competitor of Mostotrest in the bridges construction segment. According to PMR report, in 2009 the company held a 6% share of the bridges segment, while Mostotrest’s controlled the largest share of 25%. Mostovik has a broad exposure to various projects related to the 2014 winter Olympics in Sochi.

Even though the competition among major companies is fairly tough, Mostotrest as the industry leader is well positioned in the market and has a number of advantages that will enable it to strengthen its position further acquiring higher market shares. We see Mostotrest’s competitive advantage in its:

§ Integrated business model and presence in all of the key market segments

§ Best technological expertise in construction of bridges, the most complex element of transport infrastructure

§ Reliable general contractor reputation with proven track record of delivering complex projects

§ Wide geographic presence covering the most attractive regions in terms of anticipated investments

§ Strong financial position and opportunities for further expansion

Investment summary

Mostotrest started 2012 trading at RUB190 a share reaching its peak of RUB213 upon the announcement of 2011 IFRS results in mid April. The successful performance for the year boosted investor sentiment, however, the shares took a downward trend since then. This is, in our view, due to lower post-IPO trading liquidity which puts a discount on the stock as investors seek to compensate for additional risk.

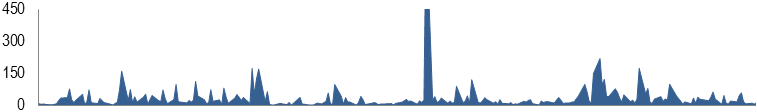

| Trading volume (ths shares) |

Figure 13. 2012 share price dynamics and corporate news

|

Source: Company data, A-team analysis

Mostotrest offers a good opportunity to tap into a fast growing sector with strong fundamentals. In fact, the infrastructure construction market in Russia is seen to grow at 12.6% CAGR during 2012-2017 with potential investments amounting to RUB13.5tn.

The company itself has a strong position which is seen through healthy profitability, low leverage and a strong portfolio of projects. In fact, MSTT has a ROE of 20%, Debt-to-Capital ratio of 30% with almost 85% of the obligations coming in the form of short-term borrowings which are fully repaid within a year, and almost RUB300 bn worth of projects in its order book.

The stock also offers an attractive dividend story paying out 54% of net income which translates into 3.8% dividend yield compared to that of 2% for the industry. In fact, Mostotrest is in top 5 companies on the MICEX (exc. O&Gs) by dividend yield. This is seen particularly attractive as investors wish to move focus from capital gains to more stable dividend returns given the current uncertainty in financial markets.

Our valuation further indicates the investment appeal of Mostotrest as the target price of RUB264 implies an impressive upside potential of 45% by the end of 2013. The stock trades at 2013E EV/EBITDA of 4.1x and 2013E P/E of 10.5x providing 23% and 18% discounts to international peers, while the one-year forward PEG ratio of only 0.7 further indicates that the stock is undervalued.

We firmly believe that Mostotrest is a good value stock, and, in fact, we assessed it against a number of rigorous screening criteria used by FTSE in order to identify quality value stocks in emerging markets that constitute its famous FTSE Value-Stocks Indices. Our expectations were fulfilled as Mostotrsest met all the criteria (Appendix E).

Taking all of these into account we give a strong BUY recommendation, as the stock, in our view, will deliver impressive returns over the course of next 12 months.

Дата добавления: 2015-09-07; просмотров: 642. Нарушение авторских прав; Мы поможем в написании вашей работы! |

|

|

|

|

Характерные черты немецкой классической философии 1. Особое понимание роли философии в истории человечества, в развитии мировой культуры. Классические немецкие философы полагали, что философия призвана быть критической совестью культуры, «душой» культуры.

2. Исследовались не только человеческая...

|

Механизм действия гормонов а) Цитозольный механизм действия гормонов. По цитозольному механизму действуют гормоны 1 группы...

|