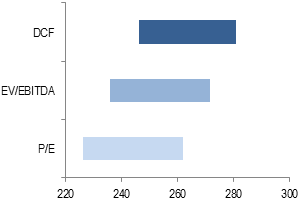

We initiate coverage of Mostotrest (MSTT), leading infrastructure construction company in Russia, with a BUY rating and target price of RUB264 which implies an upside potential of 45% by the end of 2013.

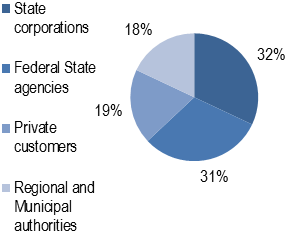

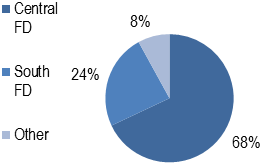

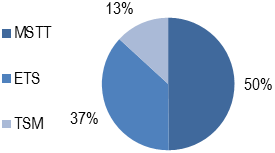

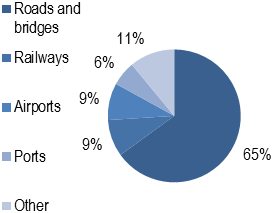

§ MSTT is a leading Russian infrastructure construction company with diversified business model and extensive geographic coverage. Mostotrest has its footprint in most of the market segments inc. construction and renovation of bridges (key segment with a 25% market share), roads, railways, airports and other transport infrastructure facilities. It has both the track record of an experienced general contractor and unique in-house expertise which allows it to undertake the most complex projects. The company’s own production capacities account for one third of materials used in construction and ensure uninterrupted supply. In addition, it operates toll roads and has recently entered the concessions segment in a strategic move to stabilize its earnings.

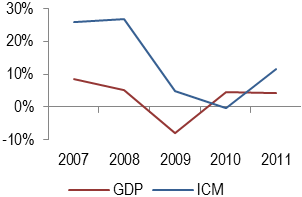

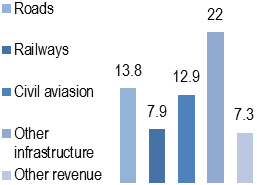

§ Attractive industry fundamentals and favorable market trends. From 1995 to 2011 the number of passenger cars in Russia increased 142% while the roads merely added 7%. Not only is the infrastructure insufficient but, it is also extremely depreciated which impedes the country’s economic development. To address this problem a number of federal programs were launched under which RUB13,500bn will be invested in infrastructure by 2017 pushing the market to grow at 12.6% CAGR from 2012 to 2017. While the market trends favor large players which is seen through increasing complexity of projects as the average tender size grew from RUB0.9mn in 2007 to RUB3.2mn in 2011, Mostotrest seems to be well positioned to benefit from this abundant investment in infrastructure and we forecast its top line to demonstrate a tremendous growth of 15.1% CAGR during 2012-17.

§ Successful replenishment of the order book with high profile projects. Thanks to its proven track record, in-depth expertise and political resources, MSTT is able to win the most attractive tenders among which are the construction of Moscow Fourth Ring Road worth RUB60bn; Kurortny Avenue Relief Road in Sochi with RUB50.3bn project value; Moscow-Saint Petersburg Highway (two sections with length of 43 and 76 km) priced at RUB83.1bn and many others.

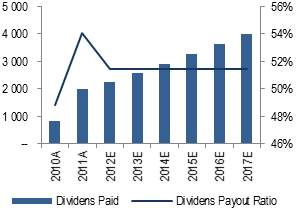

§ MSTT is a value stock with appealing dividend story. The company is committed to paying out 54% of net income which translates into sound divided yield of 3.8% against 2% for the industry. This seems to be particularly attractive under the current uncertainty in financial markets and limited capital gain opportunities as investors are searching for more stable dividend returns.

§ MSTT is undervalued by the market. Trading at 2013E EV/EBITDA of 4.3 and P/E of 10.5 MSTT provides 23% and 18% discounts to its international peers, while the low one-year forward PEG ratio of only 0.7 further indicates that the stock is a cheap buy taking into account its fundamentals.

§ The upside to our target price can be mainly seen in reduced proportion of works outsourced, lower capital expenditures and higher market growth rates.

§ Major risks: Lower revenues as result of reduced investment in infrastructure due to worsening economic situation; failure to win new tenders; rising construction costs, delays in site preparation works.

| Highlights

(RUB mn)

| 2010A

| 2011A

| 2012E

| 2013E

| 2014E

| 2015E

| 2016E

| 2017E

|

| Revenue

| 60,279

| 98,996

| 118,275

| 140,226

| 158,452

| 181,651

| 207,063

| 238,807

|

| EBITDA

| 6,488

| 9,609

| 11,001

| 12,608

| 13,708

| 15,049

| 16,343

| 17,860

|

| Net Income

| 1,730

| 3,705

| 4,327

| 5,007

| 5,629

| 6,336

| 7,019

| 7,776

|

| Profitability & Valuation

| |

|

|

|

|

|

|

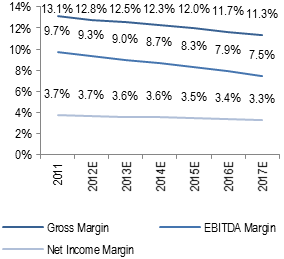

| EBITDA margin

| 10.8%

| 9.7%

| 9.3%

| 9.0%

| 8.7%

| 8.3%

| 7.9%

| 7.5%

|

| Net margin

| 2.9%

| 3.7%

| 3.7%

| 3.6%

| 3.6%

| 3.5%

| 3.4%

| 3.3%

|

| ROE

| 10.6%

| 19.8%

| 20.8%

| 21.6%

| 21.7%

| 21.8%

| 21.6%

| 21.5%

|

| ROA

| 2.4%

| 3.8%

| 3.9%

| 3.9%

| 3.9%

| 3.8%

| 3.7%

| 3.6%

|

| Profit allocation

|

|

|

|

|

|

|

|

|

| EPS (RUB)

| 6.97

| 13.24

| 15.47

| 17.90

| 20.12

| 22.65

| 25.09

| 27.80

|

| DPS (RUB)

| 3.40

| 7.14

| 7.94

| 9.19

| 10.33

| 11.63

| 12.88

| 14.27

|

| | | | | | | | | | |

Source: A-team analysis

Source: A-team analysis

Source: Company data

Source: Company data

Source: EMBS Group report

Source: EMBS Group report

Source: Company data

Source: Company data

Source: Rosstat

Source: Rosstat

Source: A-Team analysis

Source: A-Team analysis

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Company data

Source: Google Finance

Source: Google Finance

Source: A-Team analysis

Source: A-Team analysis

Source: A-team analysis

Source: A-team analysis

Source: A-team analysis

Source: A-team analysis

Source: Company data

Source: Company data