Ex. 1. Learn the vocabulary.

Ex. 2. Put questions to the underlined words.

Ex. 3. Make a syntactical analysis of the subordinate clauses (state what kind they are).

Ex. 4. Choose verbals and state their syntactical function in the sentence.

Ex. 5. Translate the texts.

LONG TERM TECHNICAL ANALYSIS

The Chartist's Trading Plan and Forex Forecasting

Before drawing up the chartist's trading plan the dealer studies historical data for forecasting and selects a traditional or modem chart for study or a combination of both.

He must choose chart patterns of note to identify a potential continuation/reversal or neutral trend with trigger level and extension target, pay special attention to moving averages and oscillators signals for an indication and confirmation of the trend, and anticipate its turns.

For in-depth analysis dealers usually use the Elliott wave count.

Generally most forex dealings are based on the dollar. And it is the movement of the dollar which is moving the financial market. The basic idea of making a profit is to buy dollars low and sell high.

The dealer can never be certain of what may occur. Unfortunately forecasting is not a science but an art and anything can happen.

By January 1994 hardly anybody thought that the dollar could fail to cross 1.80 to the Deutsch Mark. The greenback did and made forecasters shy for 1995. In fact most studies see the dollar rising but, burned by experience in 1994, predict only modest rates. Right now (02/95), as levels of about 1.50 can be seen, predictions range from 1.65 to 1.75 for the end of 1995.

Long Term Technical Analysis

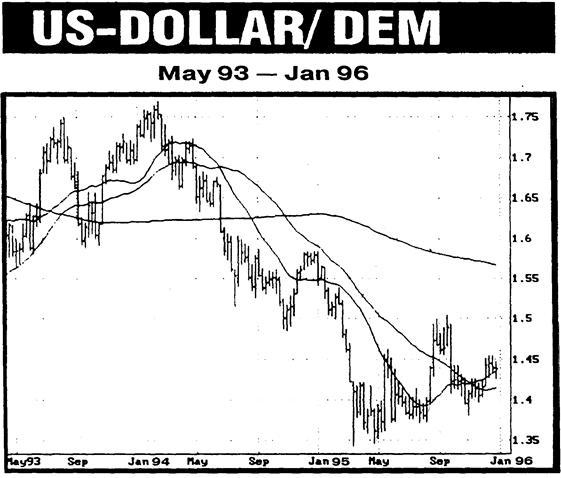

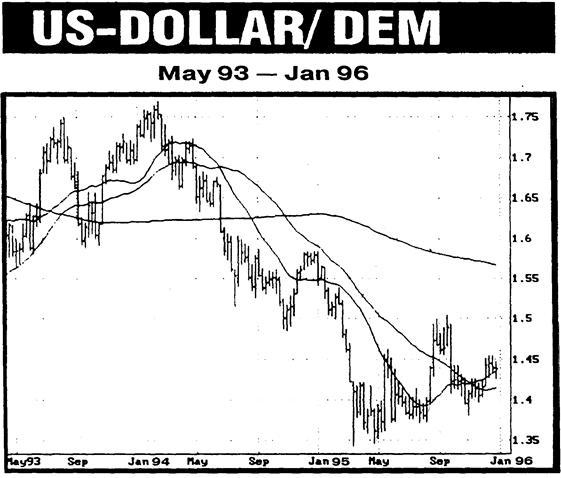

Dollar/DM Forex Rate Moves in 1995.

In December. 1994 the greenback started an upward correction which was followed by a retracement in March. Mid of May 1995 the dollar remained in the 1.36 / 1.39 consolidation range. In August the US dollar drifted around between 1.35 and 1.42 of the German Mark. By the end of the year dollar/DM broke above 1.44. The continual downward trend since the start of 1994 seemed to be finally over. All the moves of the USD/ GEM are plotted on the Chart (Jan. 1996) and analysed in the articles below.

| Dollar consolidates (Dec. 94)

| Vocabulary

|

|

| hike — повышение

|

| At the FOMC meeting of the FED on the 14th of Novem

|

|

| ber. the long expected interest rate hike became reality. The

|

|

| FED increased both the discount and the fund rates by 0.75 each

|

|

| to 4.75% and 5.5% respectively. Even before the summit, the

| FED(FRS) — Федеральная резервная

|

| greenback started an upward correction, which was continued

| Federal Reserve система США (ФРС)

|

| by the interest rate hikes, which were slightly above expecta

| System

|

| tions. The international interest rate scenario has changed dra

|

|

| matically over the last months. Contrary to the situation at the beginning of the year, where the dollar rates were around 2% below the DM rates, now the dollar rates for all maturities show a premium above the DM yields of 0.5% to 1%, this factor has to influence forex trade as well.

As the bearish sentiment will not be forgotten for a while,

we expect a Range trading between 1.53DMand 1.75DM till the end of the year. but at least the lows should be behind us.

Improving charts

After an extend test of the lows at 1.50 DM, the market re

turned into the consolidation pattern between 1.53 and 1.58,

which developed in the summer.

|

|

|

|

| FOMC — Комитет по операциям на

|

| Federal открытом рынке (ФРС) США

|

| Open Market

|

| Commettee

|

|

|

|

|

|

|

| ju: maturity — ценные бумаги со сроком

|

| погашения

|

|

|

|

|

|

|

|

| range trading — торговля в канале (коридоре)

|

| Dollar breaks 1.42 DM on the upside Dollar crisis seems to be over June, 95)

Mid of May the dollar broke the heavy resistance around 1.42 DM and left the 1.36—1.39 consolidation range on the upside. As this break-out was followed by several tests on the downside, at least from the technical viewpoint the cyclical lows should be behind us. Another bullish item is that this scenario occured without any intervention by any central bank. Obviously the market found a balance and finally heavy fund buying pushed the greenback higher. Fundamentally this action was backed by the announce

ment of stringent American trade sanctions against Japan. How important these punitive measures have already proved to be was shown by the last trade balance report. The US — Japanese trade deficit widened bv30%. despite the recent Yen surge and a lot of rancour between Mikey Kantor and his Japanese counterpart. Having tested the 80 Yen support twice, the dollar bounced back by 10% within two weeks.

The dollar finds a floor (Aug. 95)

The US dollar has been drifting around between 1.35 and 1.42 to the German mark for several months now, but at least the continual downward trend since the start of 1994 seems to be fmalv over. At the start of May a breakout to 1.45 was quickly brought to a halt. Many analysts believe though, that the dollar is between 10—20% undervalued, even if the recent data emerging from the US economy has altered that relationship slightly. The most recent interest rate cut by the FED was clearly seen as being their response to the negative economic data. It was the first cut in one and a half year, a period which has seen seven rises. Many experts predict that it will not be the last.

Buba lowers rates, but not to spur growth German interest rate cut (Jan. 96)

The Bundesbank (Buba) in Frakfurt cut the discount and Lombard rates by half a percent last month, taking them to 3 and 5% respectively. The long-awaited, but little hoped for, announcement took the markets bv surprise, following a series of rather mixed signals corning out of the Buba. Hans Tietmever. president of the bank, denied that there had been any ambiguity about the bank's intentions when he made the decision public. This brings German interest rates to their lowest level since mid-1988. and is the third such reduction within a year. It appears that the Buba was persuaded to make the decision after reviewing the progress of M3. the broad

| funds — деньги, ссужаемые банкам федеральным резервным фондом

i stringent — строгий ^

Ju: | punitive — карательный

ае rancour — вражда

э: to emerge — появляться

е respectively — соответственно

to take by — удивить surprise

эе ju ambiguity — двусмысленность

to make public - обнародовать

| |

| |

| агрегат МЗ плюс банковские депозиты частного сектора в инвалюте (Великобритания)

to run out — выдохнуться of steam

| |

| money supply figure, which showes a sharp reduction over the previous year. M3 did put on speed in the middle of the year, but then ran put of steam, and it was this slowdown which prompted the Buba to make its move. Predicted M3 growth targets of 4 — 6% were not met. mainlv due to a slowdown in economic activity. The Buba statement maintained that the latest interest rate policy was intended to put money supply and the economy on a similar oath. Other contributory factors were low inflation

| ju: 'due to

to drift into recession

a: to enhance

л to under pin

| — из-за

- скатываться к снижению деловой активности

- стимулировать подпирать

|

| and low potential for steep price rises and the continuing strength of the mark, whose protection is one of the Buba's main aims. The bank also painted a more optimistic picture of German economic potential than has been fashionable recently. and the president pointedly stated that he sees no grounds for the fear that Germany is drifting into recession. This rate cut served to underline his, and the bank's, view that economic frowth would be enhanced, not underpinned, by the cut. Analysts soeculate that a weakening of the economy or a collapse of the French currency, could force the Buba to act again and lower rates.

|