THE ELLIOTT WAVE

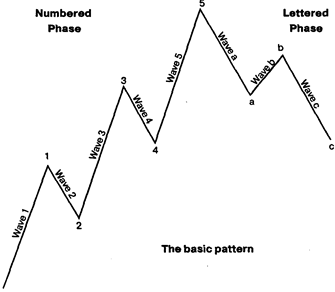

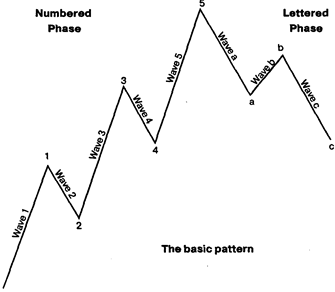

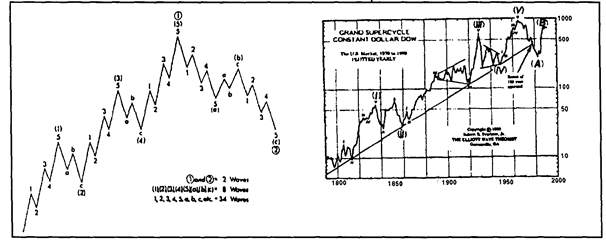

| According to Elliott a rising stock market unfolds in five-wave/three-wave pattern and forms one complete bull market /bear market cycle of eight waves (1-3-5-B). The five-wave upward movement is called an impulse wave and the counter trend movement — a corrective wave. Waves 1, 3, 5 can subdivide into five waves of smaller scale. Corrective waves 2 and 4 can form three smaller waves each too. Impulse subwaves are numbered (1-2-3-4-5). Corrective subwaves are lettered (A,B,C). Thus waves in any series can be subdivided and resubdivided into waves of smaller degree or expanded into waves of larger degree.

The larger scale pattern

| Vocabulary

ou to unfold — развертываться

i impulse — импульс, побуждение

ei scale — масштаб

se to expand — расширять

|

| The analyst should take into consideration that in an uptrend market, the low of the second wave never goes below the beginning of the first wave. The third wave is never the shortest. The forth wave does not penetrate the price range of a first wave. Market movements are essentially the same but they may differ in the size or duration. Large scale movements incorporate smaller scale subdivisions which are similar to them in their «fractal» geometry. One of the three impulse subwaves (W-1, W-3, W-5) can have extensions i.e. elongated movements. These subdivisions increase the number of waves to nine for the main sequence. The increased number of movements does not change the technical significance of price pattern.

| e to penetrate — проникать

э:

| | to incorporate — объединять

ae fractal "geometry" — «геометрия частей» фрактальная геометрия

|

TRANSLATION PRACTICE

| Elliott wave theory

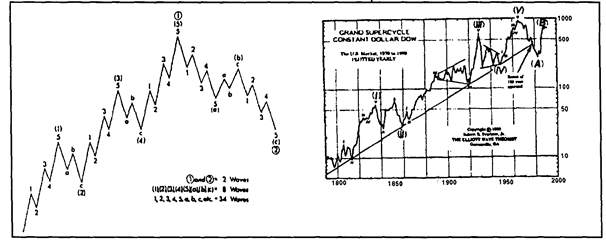

According to Elliott, markets move in cyclical waves, with

a kind ofself-similaritv within the waves. The big waves consist

of smaller waves which themselves contain smaller waves and so on. The names of the waves according to their size are as follows, with increasing length in time and amount:

sub-minuette

minuette [mmjuet]

minute [minit]

minor

intermediate

primary

cycle

super cycle

grand supercycle

The time frame starts with minutes and even single trades

and ends in movements lasting for several hundred years from

beginning to end. A complete cycle on one stage of observation consists of several movements, of which some are in the direction of the wave and some are in the opposite.

Now let us listen to Elliott himself:

"The rules to be derived... are:

1) Waves in the direction of the main movement, or the

odd numbered waves, are made up of five lesser waves.

2) Corrective waves, or waves against the main movement

(even numbered waves) are made up of three lesser waves."

The basic concept states that this structure is repeated at

the next level of waves again, like the movement of (2) to (3),

while consisting of five waves itself, is part of the next-state

movement towards (1). The system is thus valid on all possible

levels of observation and the only problem the analyst has to

solve is correct wave countine.

|

| | odd numbered - нечетные (числа)

| |

| |

| |

| |

| |

| | even numbered — четные (числа)

| |

| |

| |

| | to stretch — растягивать

| |

| |

| |

| |

| | i:

| | to proceed - проходить

| |

| |

| |

| |

| | э:

| | distortion — искажение

| |

| |

| |

| |

| | e

| | irregular — неправильный,

| | нерегулярный

| |

|

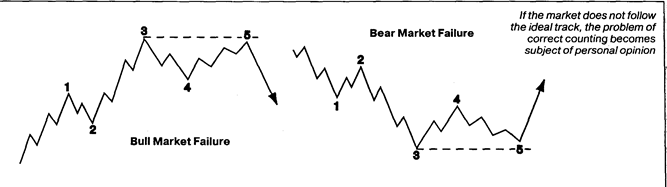

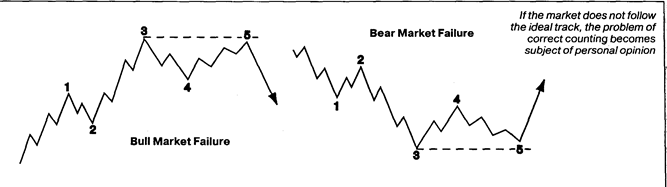

| Since markets do not move in the ideal way. some correction might fail to close above the previous correction's low, (in an upward trend like above), some of the odd moves might fail in closing above the previous odd-waves top and so on. These distortions make wave-detecting and wave-counting quite difficult and subject to personal opinion, which is the main problem when one tries to computerize the system. The main interest of the investor is always the fifth wave since it indicates a turnaround of the trend. "Sometimes the fifth wave will 'stretch', that is, deploy or spread out. The fifth wave. instead of proceeding in the normal one-wave pattern of the same degree as the movement as a whole, simply stretches or sub-divides into five waves of lower degree... Such spreading out is a characteristic of markets that are unusually strong (or weak, if a down movement.)"

| invalidity

long run

bet

| неправомерность — большой срок

- пари

|

| For distortions of the ideal structure. Elliott formed a consistent system of triangles, diagonals, irregular corrections and wave extensions. Since distorted waves can follow each other, their detection becomes extremely difficult-to-read. And

| 1Э

to inhere — подразумевать

ae self-similarity — самоподобие

э: ei interpritation - интерпретация

i: to delete — стирать, удалять

| | | | | this is the reason why Elliott could make surprising and extremely accurate predictions on the one hand at times. whereas he failed at others. Distorted waves are known ex post. but not in advance. But correct detection of distorted waves as such helps to predict the next waves ending. If this wave is distorted again, reasoned by whatsoever, prediction failed again to some extent. This offers opportunity to critics to claim invalidity of results, which is to some extent true, but which does not necessarily mark the whole system as nonsense, since the next forecast might be extremely correct. Thus the system can be right in the long-run, but the investor might suffer from distortions in the short run. Actually, only comouter-testina

could prove if it is possuble to make money with the system. (Hence that todays knowledge about pattern recognition often refers to similar ideas, yet named differently and more modern). Moreover the critics should be aware, that even the best traders are right three to four out often bets, and never know why they were wrong. Elliott Waves can make you know why you failed, which includes a kind of element of self learning. Now after having introduced the basic structure it might be interesting to conclude similarities to modern theories. First of

| |

all, the system inheres self-similarity, which is in the meanwhile well-introduced by chaos-theory approaches to financial markets.

Secondly there are similarities to modem pattern recogntion. since a five wave structure simply is—a pattern.

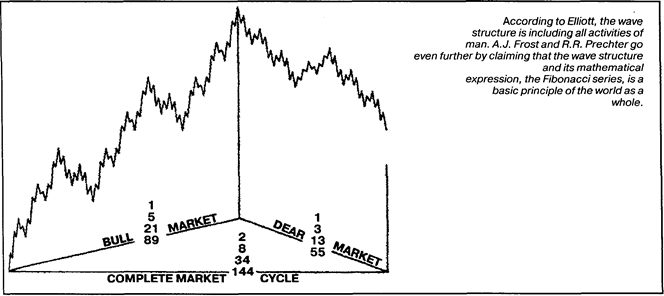

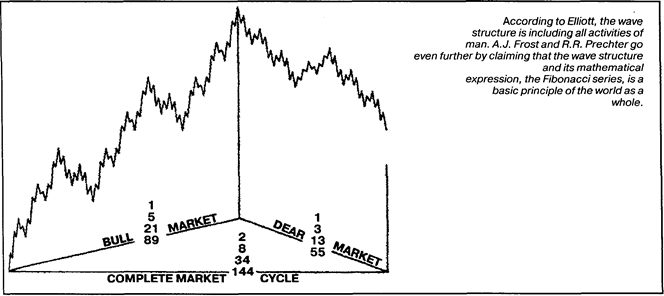

Thirdly, Fibonacci time series are quite modern as well and Elliott himself found the similarities astonishing:

"From my experience I have learned that 144 is the highest number of practical value. In a complete cycle of the shock market, the number of Minor waves is 144, as shown in the following table.

All are Fibonacci numbers and the entire series is employed. The length of waves may vary but not the number".

According to Elliott, the wave structure is including all activities of man. A.J. Frost and R.R. Prechtergo even further by claiming that the wave structure and its mathematical expression, the Fibonacci series, is a basic principle of the world as a whole.

The great variety of different interpretations of one wave and its meaning for the overall stmcture makes it rather impossible to computerize Elliott Wave without deleting some essential parts. Glenn Neelv tried to form a system which follows Elliott and works with full computer support, but he is often criticized for oversimplifying in order to computerize.

Compresension Questions

1. How does a rising stock market infold?

2. What is an impulse wave?

3. What can corrective waves form?

4. Does the increased number of movements change the technical significance of price pattern?

5. How do markets move according to Elliott?

6. What is the main problem which the analyst has to solve?

7. What makes wave — counting difficult?

8. Which wave is the most important for the investor and why?

9. Why is distorted wave detection extremely difficult?

Exercises

Ex. 1. Put questions to the underlined words.

Ex. 2. Draw up a plan of the article.

Ex. 3. Discuss the pros and cons of the Elliott wave theory. Ex. 4. Read and translate the text and the article.

FOREX FORECASTING

| Key Interest rates

U.S. — Key Interest Rates. The rates to watch are: Federal (Fed) funds rate — sets the tone for money market rates.

Discount rate — usually sets the floor for the Fed funds

rate.

The Fed funds and discount rates are the two key interest

rates. Deoositorv institutions hold non-interest bearine reserve accounts at the Fed to meet reserve requirements and handle interbank transactions. Deposits above the minimum required are traded overnight and the Fed funds rate is what banks charge each other for these overnight loans. The Fed has an objective for the funds rate which is never formallv published. However.

so-called Fed watchers can usually tell what the target is by observing where the funds rate trades in conjunction with the Fed's money market operations.

The first time the Fed announced a rise in interest rates at

The time it took place was on February 4, 1994 when it issued a statement saving that the Federal Open Market Committee had decided to increase slightly the degree of pressure on reserve positions. However, a series of rate rises in early 1994 were accompanied by formal Fed statements which the markets believe were designed to make its intentions clear. What is not clear is whether this will become the standard method by which rate changes are signalled. Traditionally. Fed watchers had to wait

until the release of the minutes of the regular Federal Open Market Committee meetings, which are published six weeks after wards, for confirmation of any perceived change in monetary policy.

All institutions with reservable deposits can borrow at the

Discount rate from the Fed's discount window for short term adjustment purposes and limited other uses. The Fed funds rate is usually above the discount rate. When the funds rate is at, or be low, the discount rate there is little use of the discount window by healthy banks which have access to the funds market.

(There is no U.S. equivalent of the lombard rate which

other central banks use to penalise institutions requiring emergency funds. However, there are circumstances when the Fed may charge a market rate above the basic discount rate. For example, borrowing under the seasonal programme is at a market rate average of Fed funds and certificates of deposit (CDs). Extended credit borrowing by banks in difficulty can also be at an above market rate.)

Open market ooerations are conducted with a eroup of pri

mary dealers in government securities (about 40) which are mainly subsidiaries of bank holding companies and securities houses. Eligible paper includes Treasury bills, notes, bonds and, for repos, government agency securities.

| Vocabulary

| | | to set the tone — задавать тон

| | |

| | |

| | | i

| | | non-interest

| | | bearing - беспроцентный

| | |

| | |

| | | о: target — планируемая цифра, установленный курс

| | | | |

| | |

| | | л

| | | in conjunction - в связи с, связанный с...

| | |

| | |

| | | ai to be designed — предполагаться

| | | | |

| | | i

| | | minutes — протоколы

| | |

| | |

| | | i:

| | | perceived — предполагаемый

| | |

| | |

| | | л

| | | for adjustment purposes — для целей урегулирования

| | |

| | | ае

| | | to have ' access - иметь доступ к...

| | |

| | |

| | | i:

| | | to'penalise - наказывать

| | |

| | |

| | | to change a rate - менять курс

| | |

| | |

| | | e

| | | 'eligible papers - ценные бумаги, отвечающие

| | | требованиям

| | |

| |

| Basically, the Fed controls U.S. monetary policy. It is often described as independent and in a narrow sense this is true: the Fed is self-financed and does not require presidential approval to change interest rates. However, the Fed can be abolished or have its terms of reference changed by Congress. The chairman is appointed by the President for a four year term only and is conventionally a political appointee. In practical terms therefore, it is virtually impossible for the Fed to follow an interest rate policy significantly at odds with that desired by the U.S. Administration.

Japan — Key Interest Rates. The rates to watch are: Uncollateralised (unsecured) overnight call rate — sets the

tone for money market rates. Official discount rate (ODR) — lagging rate of psychological significance. Japan is nearing the end of a decade long period in which most interest rates have been deregulated. These changes mean the Bank of Japan (BOJ) now sets only its official discount rate. at which it lends to commercial banks, and the liquidity deposit rate. Other interest rates are set in the open market and the BOJ aims to influence them. indirectly, through its market operations. The most important short term interbank money market rate is the uncollateralised overnight call rate. The BOJ closely

monitors call rate movements and puts most emphasis on them when managing the market. The BOJ appears to have an unpublished target zone for the call rate but the market usually gets an idea of the BOJ's target range and credit stance by interpreting the signals in its daily operations. For the past several years, the market has focused more on the amount and timing of BOJ operations. Rates set by the BOJ have rarely ruffled any market feathers, as they have been largely in line with prevailing market rates. The weekly average call rate. and its level at intervention time, can provide signals on the BOJ's policy stance. Since the BOJ prefers to signal monetary policy changes through the uncollateralised overnight call rate. the official discount rate (ODR) is now typically a lagging indicator of monetary policy. Nevertheless, the ODR still has an impact. The ODR applies to the rediscounting of commercial bills and official loans secured with Japanese government bonds (JOBs), specially designed securities and bills corresponding to commercial bills as collateral. If the ODR is increased, financial institutions find that the cost of raising funds is affected directly, via the higher cost of acquiring discount window loans from the BOJ and. indirectly. through the increased money market rates that usually precede, and often trigger an ODR change. The opposite is true for a reduction in the ODR. Under the Bank of Japan Law (1942) the Bank's policy board has the authority to formulate, direct and carry out monetary policy. While ultimate control of monetary policy rests with the Ministry of Finance, the Bank of Japan Law gives the central bank sole responsibility for changing the official discount rate. There is no hard and fast rule.

| terms of reference — круг ведения, мандат, компетенция

to be at odds - противоречить

ее lagging rate - запаздывающий курс

e deregulated — разрегулированный

call rate - онкольная ставка, процентная ставка по ссудам до востребования

о to monitor - отслеживать

ае stance — поза, позиция

л to rume - взъерошить, беспокоить, волновать

to be in line - соответствовать

ei prevailing — господствующий

to have impact — влиять

e to affect — влиять

i to trigger — вызывать sole - полный

CL

hard and fast — строго обозначенные

|

| There are seven members of the policy board, four of

whom are appointed by the cabinet and approved by both houses of the Diet (Japanese Parliament). There are four representatives from private industry, one from the Bank of Japan and two from the government. The government members, taken from the Ministry of Finance and the Economic Planning Agency, do not have voting rights.

Germany — Key Interest Rates. The rates to watch are:

Repo rate — sets the tone for money market rates.

Discount rate — sets the floor for money market rates. Lombard rate — sets the ceiling for money market rates. The repo rate is now the main tool for guiding the over

night money market rate. Repos enable the Bundesbank to adjust monetary policy without changing its headline rates. A change from a fixed to a variable rate repo (or vice versa) may indicate a policy change. But while higher rates at a variable rate repo reflect higher bids for funds by banks, they do not necessarily point to tighter policy in the short term (and vice versa).

The discount rate normally sets the floor for money market

rates while the lombard rate usually sets the ceiling. Thus, the discount rate is more important when interest rates are falling while the lombard rate is the kev rate when interest rates are rising.

The Bundesbank's main instruments are either desiened

for long mn major policy changes or to fine tune the money

market.

The Bundesbank sets monetary oolicv and is the most in

dependent of the Group of Seven central banks. It has a legal obligation to protect the external value of the mark. Without prejudice to the performance of its functions, the Bundesbank is required to support the general economic policy of the federal government. In using its powers under the Bundesbank Act, the central bank is independent of instructions from the federal government.

| u

| | Bundesbank — Центральный банк Германии

| |

| |

| |

| |

| | о

| | Lombard rate — официальная ставка

| | центрального банка по

| | кредитам коммерческим банкам, обеспеченным ценными бумагами (ФРГ)

| |

| |

| |

| |

| | еэ

| | variable — меняющийся

| |

| |

| |

| |

| | to fine tune — осуществить «тонкую»

| | настройку

| |

| |

| |

| |

| | е

| | prejudice — предрассудок

| |

| |

| |

| |

| |

|

Важнейшие способы обработки и анализа рядов динамики Не во всех случаях эмпирические данные рядов динамики позволяют определить тенденцию изменения явления во времени...

|

ТЕОРЕТИЧЕСКАЯ МЕХАНИКА Статика является частью теоретической механики, изучающей условия, при которых тело находится под действием заданной системы сил...

|

Теория усилителей. Схема Основная масса современных аналоговых и аналого-цифровых электронных устройств выполняется на специализированных микросхемах...

|

Логические цифровые микросхемы Более сложные элементы цифровой схемотехники (триггеры, мультиплексоры, декодеры и т.д.) не имеют...

|

Патристика и схоластика как этап в средневековой философии Основной задачей теологии является толкование Священного писания, доказательство существования Бога и формулировка догматов Церкви...

Основные симптомы при заболеваниях органов кровообращения При болезнях органов кровообращения больные могут предъявлять различные жалобы: боли в области сердца и за грудиной, одышка, сердцебиение, перебои в сердце, удушье, отеки, цианоз головная боль, увеличение печени, слабость...

Вопрос 1. Коллективные средства защиты: вентиляция, освещение, защита от шума и вибрации Коллективные средства защиты: вентиляция, освещение, защита от шума и вибрации

К коллективным средствам защиты относятся: вентиляция, отопление, освещение, защита от шума и вибрации...

|

ПУНКЦИЯ И КАТЕТЕРИЗАЦИЯ ПОДКЛЮЧИЧНОЙ ВЕНЫ

Пункцию и катетеризацию подключичной вены обычно производит хирург или анестезиолог, иногда — специально обученный терапевт...

Ситуация 26. ПРОВЕРЕНО МИНЗДРАВОМ

Станислав Свердлов закончил российско-американский факультет менеджмента Томского государственного университета...

Различия в философии античности, средневековья и Возрождения ♦Венцом античной философии было: Единое Благо, Мировой Ум, Мировая Душа, Космос...

|

|