1. What does the dealer have to study and select for forecasting?

2. What are chart patterns for?

3. Why did the greenback make forecasters shy for 1995?

4. What were the predictions for the end of 1995?

5. Was the continual downward trend over in 1995?

6. What brought dollar yields well above DM rates in December 1994?

7. When did the dollar break 1.42 DM on the upside?

8. How much did the US-Japanese trade deficit widen in June 1995? i 9. Did the dollar find the floor in August 1995?

| Has the starting rise in the Yen finally run its course?

Doubts rise over yen hausse in Feb. 96

In the space of 4 1/2 years the Yen has appreciated more than 60% against the US dollar. It is starting to look like this is coming to an end. This is mainly because the Japanese economy is having trouble keeping up with the international economic upswing and maintaining its competitiveness with the strong Yen.

Exports suffer

The rise in the Yen has dealt a blow to Japan's export orientated economy. Partial relief to exporters has come from rationalisation and moving production to cheaper countries. Even the famous trade surplus has shown signs that the tide is turning. Although the surplus reached 121 bn USD, this was just 0.8% higher than 1993. Motor vehicle production, the vanguard

of Japan's economic might, decreased by 6%. to 10.55 mio vehicles. Car production suffered most, falling by 8%.

Monetary policy

Rumours also surfaced that Japanese interest rates will fall. At 1.75% for the Discount rate and 3% for the Prime rate, they are by far the lowest in any of the industrialised nations. Altogether more positive is the consumer price inflation, which rose by 0.2%. and the producers index which dropped by 1.3% Unemolovment. at 2.9%. is low in comoarison to other countries, even if the figures tend to be massaged.

Dollar -Yen: Recovery or Correction Gul. 94)

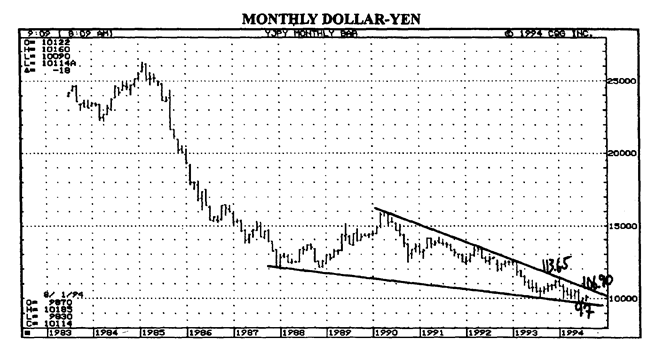

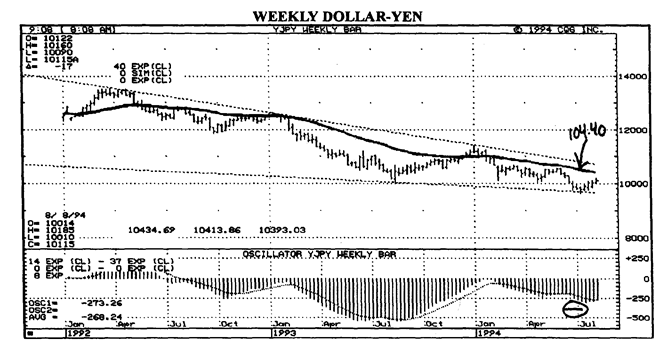

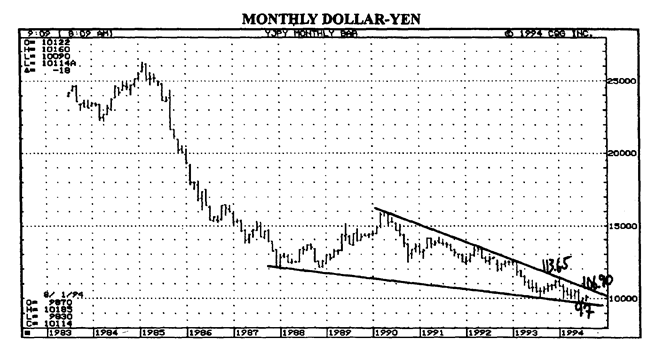

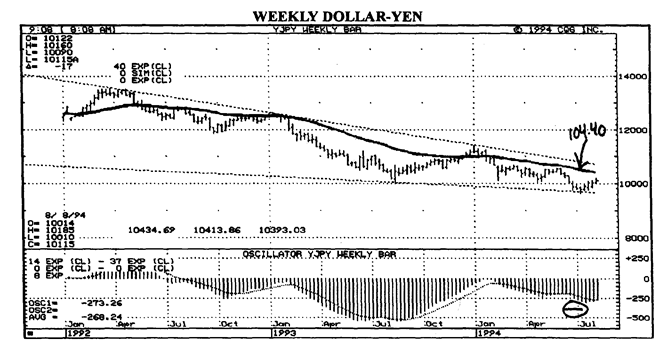

The USD recovery is impressive on a short term basis. A major trendline support level at 97.00 last month is forging ahead through many levels of resistance. The dollar buyers were attracted by the rally effort through an old trendline off the 1993/94 lows at 100.40—100.50. The long term technical analysis still views USA strength as corrective to the long bear market. A large coiling down trend pattern since 1988 is still evident on the monthly chart. The dollar tested and bounced off the low end of the formation at 97.00. The upper boundary at 106.50—106.90 should be watched. A monthly close over here points to the end to the bear market and the start of a major USD base. An uptrend cannot be expected until the early 1994 high at 113.65 is removed. The weekly chart also reveals the large coiling pattern. Near the 103.90—104.40 area a falling 40 week moving average trend indicator can be seen. The market condition could be

| Vocabulary

to deal a blow — нанести удар tide is turning — положение меняется bn (billion) — миллиард mio (million) — миллион

S3:

to surface — возникать by far — значительно

ju: consumer price — потребительская цена

ju: producers index — индекс промышленных цен

|

| о: to massage — массировать, обрабатывать

л

|

| upside — повышательное движение цены

о: target — плановая, ожидаемая цена

е exceptable — составляющий исключение

test — приближение цены к точке сопротивления (поддержки

coil — спираль

au to bounce off — отскакивать

au boundary — граница

ou slope — наклон,скат

ai sideways — цикл с горизонтальным движением цен

л

|

| recovery — подъем рыночной конъюнктуры

о: to forge — медленно двигаться вперед

ае rally — повышение

|

| called a corrective situation within a bear market if price is rising toward a still falling trend indicator. The weekly oscillator is also rising from a bearish level.

The short-term picture for dollar-yen should stay mildly

favorable for the USD as long as values hold over a support zone set by a rising 40-day moving average at 100.30 and the rising trendline off the July lost at 98.80—98.70. Dips should be supported until that area is broken. Near-term upside targets are 102.10—20 and 103.20. These values represent 62 to 75% retracements to the June/July downleg in the dollar. If a larger bear phase is still in progress, those are exceptable retracement

parameters for bear market corrections. Closing action under 98.70 should indicate the start of a new, and probably final, downleg for the dollar against the yen. The target for a new downleg will be 95.50-94.50. Secondary technical aspects are somewhat mixed. Market sentiment indicators are neutral.

There are no important cycles working for price right now. The seasonal tendancy for the yen versus the dollar is to rally from August into October. If new topping signs show in the dollar as the seasonals, one more low later this fall is possible.

| ou

|

|

| close

| — курс (цена) при закрытии

|

|

| торгов

|

| ou

|

|

| low

| — низкое значение(цены)

|

| ai

|

|

| high

| — высокое значение(цены)

|

|

|

|

| э

|

|

| bottom

| — самый низкий уровень

|

| fisher

| — ловец

|

|

|

|

| e

|

|

| correction

| — движение цены в

|

|

| направлении, обратном

|

|

| тренду(коррекция)

|

|

|

|

| ai

|

|

| to 'highlight

| — высвечивать

|

Compresension Questions

1. How much has the yen appreciated against the US dollar for 4'/^ years?

2. Why is this appreciation coming to an end?

3. What was the result of the yen rise?

4. What was the trade surplus?

5. What do rumours say about Japanese interest rates?

6. Is unemployment in Japan high or low?

Exercises

Ex. 1. Put question to the underlined words.

Ex. 2. Read and translate the text.

Ex. 3. Using the chart and the various technical studies and trendlines describe USD/DEM price movements from

May 93 to Jan 94 and USD/JPY from 85 to 93. Ex. 4. Translate the dialogue from English into Russian in writing and from Russian into English orally.

Dialogue

Client: What is your medium term outlook for dollar/DM in 1996?

Broker: Dollar/DM broke above 1.4435 in December 95 But the impetus was weak.

CL: Resistance at 1.4580 was too dense for it. Wasn't it?

Br: Yes, you are right. But the subsequent retracement from this area has allowed the market to build strength for

another assault on the upside. Cl: What could be a possible target area of the assault?

Br: A break above the 1.4545/80 zone is likely over the coming month, it may trigger a rally to 1.5045 initially. Cl.: Thus the medium term objective remains 1.56/1.58. Br.: That's right. Dips should continue to find good support in the 1.4280/65 band. Cl.: What can you recommend?

Br: I would advise you to hold longs, adding on dips to 1.4340/00, keeping the stop/reverse below 1.4265/60. CL: Shall I cover longs?

Br.: Cover longs on rallies to 1.4545/80, reinstating on a break. Cl.: Is there any danger of a correction? Br.: Loss of 1.4265 will signal a deeper correction towards the 1.40/1.38 area. My advice is: reinstate longs here, stop/reverse below 1.37.